2022 | Q2 - Bridge Over Troubled Water

“Whatever it is, the way you tell your story online can make all the difference.”

- The opening words of Rudyard Kipling’s “If: A Father’s Advice to his Son

The first half of 2022 was, from an investment standpoint, one for the record books. Markets confronted a perfect storm, one with hurricane-force winds. The economic challenge presented by the highest inflation rate in 40 years was met with a bloody land war in Europe and supply chain issues exacerbated by an economic lockdown in China. The bond market experienced its worst six-month performance in history. The stock market suffered a 20% decline, its worst performance for the opening six months of a year since 19701

In this environment, it isn’t hard to see why many lose their heads. With the Federal Reserve’s dramatic policy shift leading to much higher short-term interest rates and the end of its regular injections of artificial liquidity in the markets, investors have a choice to make – assume that the challenges of today signal a permanent decline in opportunity, or find a “bridge” to future prosperity.

We note the market’s recent connection to 1970, the same year Simon and Garfunkel released their last studio album together – “Bridge Over Troubled Water”. The title track was a soaring ballad with a message for the times. As the world coped with what seemed like “troubled waters,” Paul Simon’s song offered a sense of reassurance (“I’m on your side oh, when times get rough”). Its message is as timely and relevant today as it was then.

©Christopher Weyant/The New Yorker Collection/The Cartoon Bank

The Investment world rotates

2022 is markedly different from the recent past. The Federal Reserve, finding itself behind the curve on inflation, signaled a major, but not entirely unexpected, policy shift in late 2021. The Fed made clear it was turning off the “free money” spigot by reducing liquidity in the market and rapidly pushing interest rates higher. As we anticipated and have written about, the Fed’s policy reversal drastically altered the investment landscape. It took a significant toll on what had been red-hot growth stocks, primarily in the technology sector. The success of these stocks was highly reliant on the artificial liquidity created by the Fed. With the central bank suddenly working from a different playbook, investors wed to previously successful “momentum” strategies faced the wrath of the market’s storm surge. The rotation to value stocks that we had long predicted had finally begun.

Then, two different events caught the markets by surprise and changed the environment again:

Russian tanks and troops rolled into Ukraine, starting a violent and destructive ground war in Europe. This seemed almost unimaginable in the post-Cold War era. Along with the terrible consequences for the Ukrainian people, it strained the global economy. This is due to Russia’s significant role as an energy supplier, particularly in Western Europe, and the key role both Russia and Ukraine play in exporting agricultural commodities. In addition, western nations used economic sanctions as one of the primary methods of combatting Russian aggression.

China responded to ongoing COVID-19 outbreaks by shutting down major cities and grinding economies in those regions to a halt. This added to existing supply chain disruptions and stoked fears that more economic fallout may result before we’re finished with the pandemic.

The “hurricane” of negative headlines has battered the market. The damage has been felt across the board – by growth and value stocks, across every market capitalization, and around the globe. By March, a large percentage of individual stocks already crossed the threshold of “bear market” status (a decline of 20% or more from their peak). On a broader scale, the NASDAQ Composite Index reached bear market territory in March. By mid-June, the S&P 500 joined the bear market roll call. Few corners of the equity market were spared.

The indiscriminate nature of the negative investment environment was not limited to the stock market. Unlike most typical bear market periods for equities, investors found no respite in bonds. For only the fourth time in the past 100 years, stocks and bonds both declined for two consecutive quarters. 5-year U.S. Treasury notes were hardly the safe haven they are perceived to be. They generated a six-month return of -7.4% through May, its second-worst six-month period ever.

Likewise, there was no shelter to be found in newer, more speculative types of investments, such as cryptocurrencies. That market experienced a virtual collapse, with the global value of all crypto currencies plunging by nearly 70% from its peak in late 20212, raising questions about the long-term viability of this trendy investment alternative.

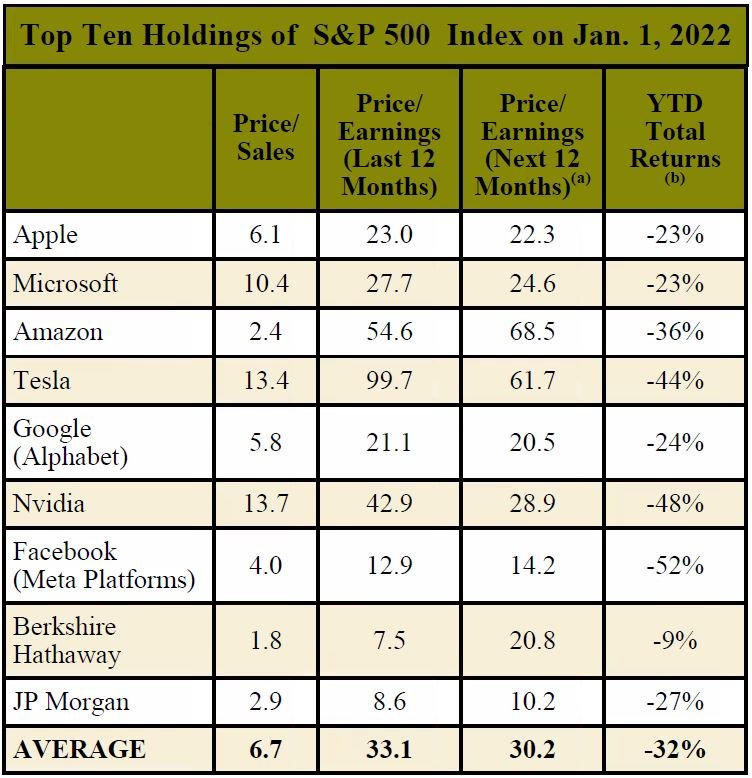

Bridge-building with value

As shown here, the ten largest stocks in the S&P 500 at the beginning of the year (primarily growth-oriented investments, mostly in the technology sector) suffered serious setbacks in the first six months of 2022. As a group, these stocks lost nearly one-third of their value.

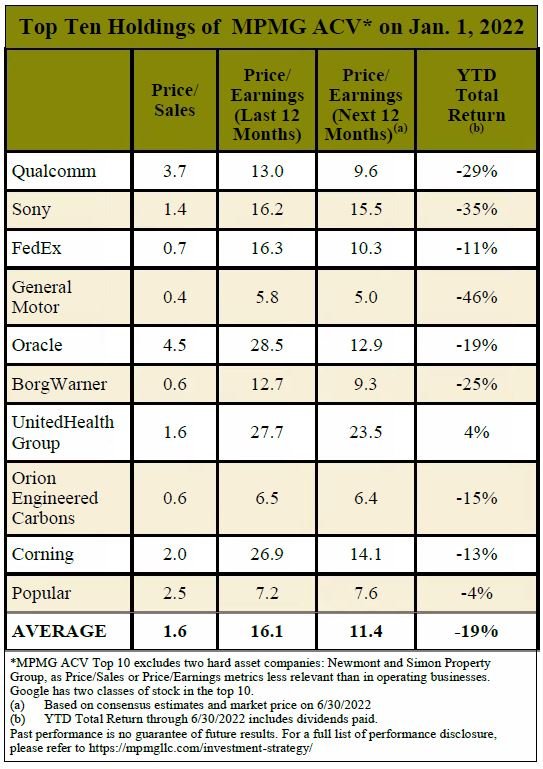

It’s only fair to point out that the largest holdings within MPMG’s All Cap Value (“ACV”) portfolio were not immune to the broadly indiscriminate nature of negative market sentiment that took hold by late February. While value stocks weathered the storm better, this particular market hurricane seemingly left everyone wet.

The more important story, in our judgment, requires you to look past the recent performance to discover the “bridge” to recovery. It’s found in comparative data, and the foundation of that bridge is valuation. Key measures to look at include price-to-sales and price-to-earnings ratios, the health of balance sheets, the earnings trajectory, and dividend yields. These variables appear quite favorable for the top holdings in the MPMG ACV portfolio.

Because today’s environment is dramatically different from the “free money” decade-plus we’ve just experienced, investors are not likely to expect a replay of the “growth at any price” doctrine of recent years. Price and the underlying value of specific investments should take priority. The “hurricane” may not yet be past us, and it may take time for the environment to become more favorable, but patient investors should (in our view) be lined up to cross the bridge over troubled water.

News evolves, and so do markets

The negative sentiment about today’s economy and markets is almost palpable. It can cloud an investor’s perspective. Yet the market’s focus on external events and the results that followed are not, in our opinion, permanent features. Like hurricanes, bear markets and economic challenges eventually subside.

Greed became the predominant emotion driving the markets once we moved past the 2008 financial crisis. Today, fear has overtaken greed as the dominant sentiment. It’s been a time when the distraction of negative headlines overwhelms fundamentals that typically drive the market. This is what temporarily sidetracked the rotation into value in February. Yet this, too, shall pass.

The war in Ukraine will, we hope, end sooner rather than later, but even if it lingers, the world economy is likely to adjust to its impact and move forward. China’s major shutdowns have ended for now, and we can hope they become a thing of the past. Inflation may remain an issue, but there are signs that it may have peaked. The global economy may be at risk of entering a recession in the coming months, but even if that happens, there is no apparent “outlier” risk (as in 2008’s financial crisis) that would cause it to be anything more than a run-of-the-mill setback.

What isn’t likely to change is the Fed’s approach to monetary policy. Interest rates are likely to remain higher for an extended period. As outlined in previous newsletters, elevated interest rates set an exceptionally high bar for growth-oriented stocks valued more for their future earnings than their current performance. If interest rates remain higher, the present value of future earnings will be reduced, which effectively puts a damper on the upside for growth-oriented stocks.

By contrast, history has shown that stocks that are valued more for their current financial results, that pay dividends to shareholders, and that are priced appropriately, are much better positioned for such an environment. They are the bridge to overcome the “fear factor” that exists in today’s markets. The rotation favoring value stocks is likely to resume before long.

A historical reminder

We noted earlier that the stock market’s performance in the first half of the year was the worst start to a year since 1970. Not to be ignored, however, is the fact that that the markets recovered in the second half of that year. In the second half of 1970, stocks gained 26.5% and ended the year in positive territory1. We can’t guarantee that the experience of 1970 will be replicated in 2022, but history provides an important reminder. Markets do bounce back, and the “troubled water” that led to the significant decline in 2022 will, in all likelihood and in due time, become calm again.

There are four key reasons why we see this as an opportunistic time for investors:

- Inflation is a burden today and we may experience an extended period of elevated inflation, but that should not deter equity investors. Two-time MPMG Speaker Series presenter Jeremy Siegel points out that over time, stocks outpace inflation by 4-5% a year3.

- Even as many investors moved money out of equities in recent months, corporate insiders have followed a different course and have been on a buying spree. For example, in May, more than 1,100 corporate executives and officers bought shares of their own firm, exceeding the number of “insider” sellers for the first time since March 2020 marked the pandemic bottom two years ago4. Insider buying has historically been a very effective market signal, as company executives and officers should know their businesses better than anyone. This buying binge seems to indicate that officers and directors are confident that their companies can deliver profits amidst the current climate. It is worth noting that the insiders also demonstrated a similar enthusiasm for their own stocks back in August 2015 and late 2018. History shows that August 2015 preceded a market bottom, and late 2018 coincided with a market bottom.

- Despite recession concerns from many economists, consumers are in a strong position (reasonable savings, manageable debt levels), jobs remain plentiful with unemployment near historic lows, and corporate balance sheets are strong. The economy does not appear to be headed towards doom, particularly if the Fed succeeds in tamping down inflation. This is why a recession is hardly inevitable in 2022, and if it does occur, is likely to be shallow and brief.

- We own a portfolio of what we believe are amazing companies – firms that provide essential goods and services, with strong financial underpinnings. Most are well-positioned for long-term prosperity as they have meaningful advantages over their competitors. We believe the true worth of these stocks has been obscured by today’s “hurricane” conditions, which now price them at an incredible value. Ultimately, investors (or acquirers) will recognize the opportunity as well, as these stocks will be rewarded.

©Liza Donnelly/The New Yorker Collection/The Cartoon Bank

Finding that bridge will, in our opinion, lead investors on the ultimate path to prosperity. Paying the right price for stocks is a game-changer for long-term wealth creation. This is especially true in times like these. While some investors sort through the rubble of their portfolios, savvier investors are thinking about the opportunities created by the developments of recent months.

~MPMG

1Cox, Jeff, “This was the worst first half for the market in 50 years, and it’s all because of one thing – inflation,” CNBC.com, June 30, 2022.

2Brett, David, “The bear market story and what next – in six charts,” Schroders, June 23, 2022.

3Min, Sarah, “Wharton’s Jeremy Siegel tells investors they ‘won’t be sorry’ a year from now if they start deploying cash,” cnbc.com, June 13, 2022.

4Wang, Lu, “Insiders Put Recession Angst Aside to Binge on Their Own Stocks,” Bloomberg.com, June 16, 2022.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.