2024 | Q1 - The New World

“The greatest secrets are often hidden in the most unlikely places.”

- Christopher Columbus

“The New World” is a term that engenders images of hope and possibility. It is most closely associated with Christopher Columbus’ late 15th-century voyage that brought him and his crew to the Americas for the first time. Columbus’ transcendent journey set off an age of exploration, with voyageurs subsequently surveying all corners of the globe. What had been a much more confined, European-centered society, was suddenly exposed to the potential of untold fortune and infinite possibilities.

Today, we stand at the precipice of another, humanity-shifting opportunity. The voyage this time is not about ships, but about chips! It centers around rapid advancements in artificial intelligence (“AI”). This astonishing technological leap again offers the potential to open new worlds and to massively alter business, industry, and society in unimaginable ways. Though we are only in the nascent stages of this revolutionary development, it is fair to say that the possibilities are limitless.

©Bruce Eric Kaplan/The New Yorker Collection/The Cartoon Bank

Yet many investors mistakenly assume that the AI ship has already sailed. They’ve watched a massive stock market rally driven largely by soaring prices for a handful of stocks tied to the development side of the technology. What’s not as obvious yet is the queue of companies lining up behind them, ready to leverage AI’s capabilities. The beneficiaries will be numerous.

If it’s obvious, it’s obviously wrong

Investors’ frantic compulsion to jump on the AI bandwagon is a familiar response. Many are fervently chasing the most obvious and immediate beneficiaries of this new, “hot” thing, namely, companies that are initially vital to creating AI’s backbone. Investors who believe this represents the pinnacle of AI’s niche don’t appreciate the lifecycle of innovations. AI offers vast investment possibilities, but if history is any guide, we know that AI-related market leadership will rotate. While some of today’s market beneficiaries can be considered “creators” of AI, the cycle will work through to “enablers,” and eventually to companies that can be labeled as “users” of AI. The future beneficiaries of this transformational technology will extend far beyond the immediate winners that already represent a significant, long-term valuation risk. The “users” that apply AI capabilities as part of their long-term strategy offer tremendous upside potential, without carrying the overvaluation risks of the “creators.”

The last time that a similarly transformative technology created such excitement in the market was during the rise of the Internet, which first emerged in the 1990s and became mainstream in the 2000s. One might assume that as integral to the business world and society at large as the Internet has become since that time, technology companies would be the dominant wealth creators. Yet a survey of stock performance from 1990 to 2020 showed that of the 30 stocks creating the most shareholder wealth, more than half were non-technology companies. Furthermore, three of the top ten wealth-creating stocks for those 30 years did not, in 1990, yet exist. 1

©Barbara Smaller/The New Yorker Collection/The Cartoon Bank

To suggest that the “winners” of a new, transformational technology are already known seems misguided, when in fact, the greatest beneficiaries will most likely include companies that have yet to be created.

History shows us that the early beneficiaries of innovation often do not endure. For example, in the 1990s, a select group of Internet companies were quickly positioned as “obvious” winners. AOL (America Online) was, at that time, the largest online service provider and the most recognizable name on the Internet. It was even the key plot device of a hit movie, “You’ve Got Mail.” Global Crossing provided computer networking services and leased lines that enabled communications via the World Wide Web. JDS Uniphase was another darling stock of the new era. It made lasers for chip makers and scanners. Sun Microsystems manufactured and sold computer servers, critical infrastructure for the Internet. Cisco Systems was one of the biggest success stories of the time. It sells networking hardware and software and still serves as the backbone of the Internet. However, this first wave of Internet leaders of the late 1990s and early 2000s either reached unsustainable valuations or, more commonly, failed to remain relevant compared to more agile and innovative companies that came after them.

Mobile phone technology underwent a similar transformation. Remember the days when a BlackBerry phone was considered the cutting-edge tech appliance? It held 50% market share in the U.S. mobile phone market as recently as 2009. Its market share is virtually 0% today.2 Other prominent mobile technology names of that era – Nokia, Motorola, Palm, - are mostly an afterthought in today’s market.

By contrast, one of the enduring winners of the era (and one of the top 10 stocks from 1990 to 2020) was Walmart, clearly classified as an Internet “user”. By the late 1990s, no company had a larger “brick-and-mortar” presence. Walmart, on the surface, looked like a potential dinosaur in the retail trade, as the likes of Amazon and eBay gained the lead in “e-tailing.” Yet more than a quarter-century after the Internet revolution began, Walmart may represent the best example of a traditional retailer adjusting its business to incorporate Internet capabilities. It demonstrated that it can enhance its significant retail footprint with an online presence as well, building its business and improving in-house efficiencies in the process.

Walmart is just one example of a company that successfully leveraged the available Internet infrastructure created by others. Countless other successful firms found ways to harness this new technology and create wealth by more effectively penetrating existing markets, making inroads into new markets, and adding efficiencies to their processes and production times.

Finding the AI winners

It is difficult to overstate the scope of change that AI may bring about in the years and decades to come. The use of generative AI could eventually add over $4 trillion to the global economy annually, according to estimates from McKinsey and Company.3 Another projection is that productivity gains in the retail and consumer goods sector will help reduce costs and improve profitability. For example, the home improvement giant Lowe’s is incorporating the AI tool ChatGPT to help give consumers advice on their own projects3. Imagine how much more business Lowe’s could generate, without adding significant labor costs, by giving consumers access to timely information that empowers them to take on home improvement tasks on their own.

Just as was the case with the rise of the Internet, we’re likely to see the benefits of AI spread to a much broader group of businesses. Among the potential beneficiaries likely to adopt AI to enhance productivity and profitability are firms in the fields of:

· Materials: Copper is a critical component of AI’s backbone. The demand will be driven by the growing electricity requirements for data centers and the need to connect network computers.

· Healthcare: AI can be leveraged for earlier and more accurate detection of life-threatening diseases. It also will likely spur more rapid advances in the development of new drugs and technology. Delivery of medical services can be streamlined with the support of AI.

· Transportation: Advancements in autonomous vehicles, which could be particularly beneficial for overland shipping of goods, could be accelerated with AI advancements.

· Research and Development: Everything from mineral exploration to biotechnology should benefit from the power of AI. Technological advancements can hasten processes involved in R&D and add efficiencies that improve profitability for companies that pursue new opportunities.

· Manufacturing: AI helps spot weak points in production lines and anticipates potential maintenance needs. It can make processes that up to now relied on human resources much more productive and predictable.

These are just some of the applications that offer obvious potential. Well-managed companies that have the foresight to incorporate AI into their development plans will be advantageously positioned for the future. In our portfolio, we believe that companies as diverse as Deere & Co., Generac, IBM, Newmont Mining, Oracle, Parker Hanafin, and Qualcomm are all among the most immediate potential beneficiaries of AI advancements.

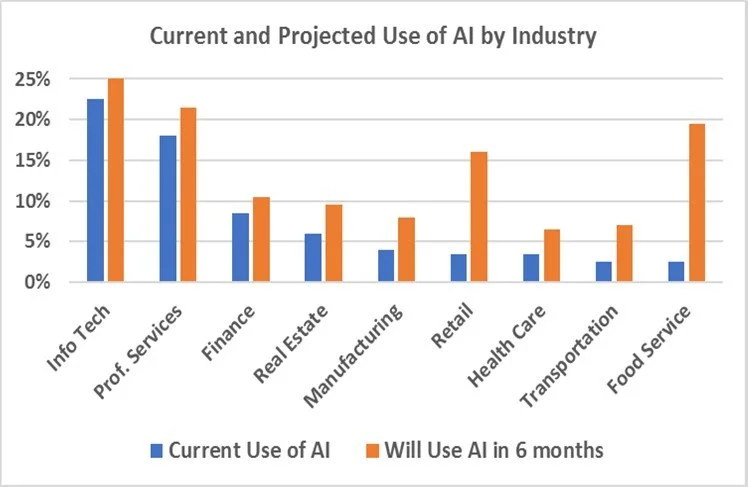

U.S. Census Bureau, “Tracking Firm Use of AI in Real Time: A Snapshot from the Business Trends and Outlook Survey,” March 2024. Studies conducted for two week periods ending Dec. 3, 2023 and Feb. 11, 2024.

The changes may come about faster than people realize. A recently issued U.S. Census Bureau study highlights how many industries anticipate AI’s rapidly growing impact in their day-to-day operations yet this year (note the significant change projected in the retail and food service sectors).

Consumers and end users will ultimately benefit from the power of AI. The latest advancements, and ones yet to come, can fuel tremendous growth opportunities for well-managed companies with their eyes firmly focused on the full potential that AI offers.

AI is the focus of our Speaker Series event

Summer will be here soon, and so too will our MPMG Speaker Series event in August. This year, it features an expert on this most timely topic. Zack Kass is considered to be an AI pioneer, and for good reason. He served as the Head of “Go To Market” for OpenAI, the organization that introduced the world to ChatGPT, the revolutionary AI chatbot that started what some refer to as the “AI Spring” in 2023. Kass’ role was to channel OpenAI’s innovative research into tangible business solutions. While it’s not hard to find people who can opine about the impact of AI, what makes Kass unique is his ability to demystify this new technology. He’ll share a clear-eyed and knowledgeable perspective about AI’s possibilities for humanity’s benefit, as well as the real-world risks that need to be addressed.

Remembering old-world lessons…as we appreciate the new world

Neuroscientists have shown that humans have difficulty processing large numbers. For instance, many of us, upon hearing the figure “one trillion,” struggle to comprehend just how significant it is. Allow us to refer back to Christopher Columbus’ time to help illustrate a point.

Using the year Columbus sailed to “The New World”, as a starting point, consider this hypothetical scenario. Were a person handed $5 million per day every day from January 1, 1492 through March 31, 2024, the simple math still wouldn’t add up to $1 trillion (you would accumulate a little over $970 billion).

We use this improbable example to make a point. Approximately $1 trillion is the value by which the market capitalization of Nvidia, the company considered the poster child of the AI revolution, increased in just the first three months of 2024.4 It’s as if investors assume that Nvidia will be the only notable AI winner. To the contrary, we believe that the higher its valuation, the greater the likelihood that Nvidia’s stock will suffer under the weight of unrealistic investor expectations, despite AI’s bright future. It’s a scenario that we’ve seen repeated throughout history.

Perhaps there is no better collection of people who don’t understand the magnitude of $1 trillion than our elected representatives in Washington D.C. In March, the U.S. President unveiled a $7.3 trillion budget for the 2025 fiscal year, which starts this October. According to the Congressional Budget Office, this will likely result in a $1.8 trillion deficit. Not only does the $970 billion+ accrued post-Columbus example fall short of the annual deficit, but it pales compared to the $34 trillion of accumulated federal debt.

The rapid escalation in Nvidia’s valuation and the increasingly bloated federal deficit serve to demonstrate some of the key hazards that we see evolving in the financial markets. We believe that just as explorers like Columbus had to respect the risks posed by uncertain seas, we must do the same, in the context of the markets. The environment has changed, and economic winds have shifted. Momentum and risk-agnostic investors would be wise to embrace traditional, “old world” rules of investing.

Rising deficits and debt levels, coupled with persistent and elevated inflation rates, are driving higher interest rates. If history is any guide, these higher interest rates will spell trouble for the high-flying technology names with egregiously high valuations. These technology company valuations, which are overwhelmingly dependent on earnings far off in the future that may not materialize, are worth less when those earnings are discounted by today’s higher interest rates. Meanwhile, opportunistic investors can find numerous overlooked businesses that are perceived as “sleepy” and “boring” and whose valuations are not overly dependent on future earnings. These businesses are already great companies. We believe these overlooked and ignored businesses offer less risk and greater appreciation potential because they (i) have bargain valuations, and (ii) aren’t nearly as reliant on future earnings that are jeopardized by competition and technological obsolescence as the technology darlings.

Not all overlooked, more traditional companies are positioned to benefit equally. Many companies shortsightedly mismanaged their balance sheets with burdensome debt levels when interest rates were artificially low. Now that interest rates are rising to more normalized levels, these companies face higher costs to service their increased debt levels. These elevated debt servicing costs will limit their ability to compete with businesses whose growth plans aren’t as dependent on cheap access to funds. The result of higher interest rates will likely mean that there will be greater stock price dispersion between the poorly and well run companies. An economic environment with stubbornly high inflation and mounting government deficits will also likely continue to create opportunities in gold and gold mining stocks.

In Columbus’ time, many expeditions to “The New World” proved to be ill-fated. Seasoned voyagers knew that proper planning, a sea-worthy vessel, and masterful navigation that avoided unnecessary risks, were vital to reaching a desired destination. Similarly, wise investors know that potential prosperity in the new AI world may be centered in companies that are positioned to profitably apply the technology. Yet given the realities of today’s choppy economic seas, the path to prosperity requires paying the right price for these stocks to help smooth the ride and realize the full potential of this transformative opportunity.

~MPMG

1 Burrows, Dan, “The 30 Best Stocks of the Past 30 Years,” Kiplinger.com, Feb. 23, 2023.

2 Adit, Siyam, “The Importance of Evolving Product Design: A Case Study of BlackBerry’s Rise and Fall,” Bootcamp, Apr. 27, 2023.

3 Escobar, Sabrina, “AI Will Transform Retail. These Stocks are Early Winners,” Barrons.com, March 22, 2024

4 YCharts.com (https://ycharts.com/companies/NVDA/market_cap)

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.