2021 | Q2 - The Future is Not Something to Predict… But to Navigate

“We predict too much for the next year and yet far too little for the next 10.”

– Apollo 11 astronaut Neil Armstrong

People have long been tantalized by the purported ability of some to predict the future. Whether it was fortunetellers, palm readers, Las Vegas odds makers, or computers spitting out algorithmic models, predictions have always captured the imagination. Unfortunately, trying to flawlessly anticipate everything about the future is an exercise in futility. Consider what transpired over the past 16 months as evidence of this. In early 2020 the deadliest pandemic in a century brought the world economy to its knees. Facing an uncertain future, the headlines were focused on infection rates and death tolls. Fast forward to today, and the temperament of the public and investors is optimistic (even considering the latest market pullback). There is perhaps no greater symbol of this resurgence than Sir Richard Branson’s recent voyage into space, an event that few could have anticipated just a few years ago. As portfolio managers and stewards of our clients’ wealth, we are never so brazen as to think that we can know all that the future has in store. But . . .

©James Stevenson/The New Yorker Collection/The Cartoon Bank

That was then, this is now

The ability to observe the world through a neutral filter, analyze data devoid of preconceived notions, and keep your head when all about you are losing theirs have proven to be adequate substitutes for a magical crystal ball. During the darkest days of the pandemic we wrote numerous letters on the importance of not letting the immediate challenges and scary headlines distract our clients from the longer-term opportunities that existed. The courage demonstrated by our clients proved to be the difference between profiting from a dramatic rebound and losing out on a major opportunity. That was then, this is now.

We believe that we have reached an inflection point for investors. We believe that successful investing will require greater discernment than was needed during the market’s recovery from the pandemic lows of 2020. Our research points to the continued development of several scientific, technological, and economic developments taking place in the world today. We believe that the continued emergence of these themes will be a source of tremendous opportunity for investors. It isn’t possible to know the future with absolute certainty, but we believe that our portfolio is positioned to navigate this uncertain future by being a beneficiary of these megatrends in non-obvious ways through ownership of unique and under-appreciated businesses.

The seven key themes that we have identified, and the businesses that we believe stand to benefit greatly from them, are as follows:

Theme #1 – Infrastructure – closing a gap

Infrastructure like transportation, utilities and digital technologies serve as the core of the economic machine. Yet much of this nation’s major infrastructure was designed more than half a century ago. Since then, our population has doubled, and many roads, bridges and airports have deteriorated. Now we trail much of the world in updating infrastructure. It is estimated that a gap of more than $15 trillion exists between current infrastructure spending trends and what is actually needed to keep pace with global demand by 2040¹. This is already a big discussion point in Washington. Expect to see much more emphasis on infrastructure in the years to come, not just in the U.S., but also across the globe. This will include more traditional forms of infrastructure such as transportation systems and utilities as well as clean energy projects and digital infrastructure like expanded broadband and 5G technology (more on that below).

We’ve captured opportunities in this area with companies like Caterpillar, the world’s leading manufacturer of construction equipment, and Siemens, the German firm considered to be a leader in transportation equipment and “smart” infrastructure designed to improve efficiency and sustainability. Another major holding that should benefit from the increased emphasis on infrastructure spending is Terex, which makes work platforms for construction sites, and materials processing machinery for bridges, canals, streets and airport surfaces. We also like Canadian Pacific, a major freight hauler and supply chain expert that should see an increase in demand for its services.

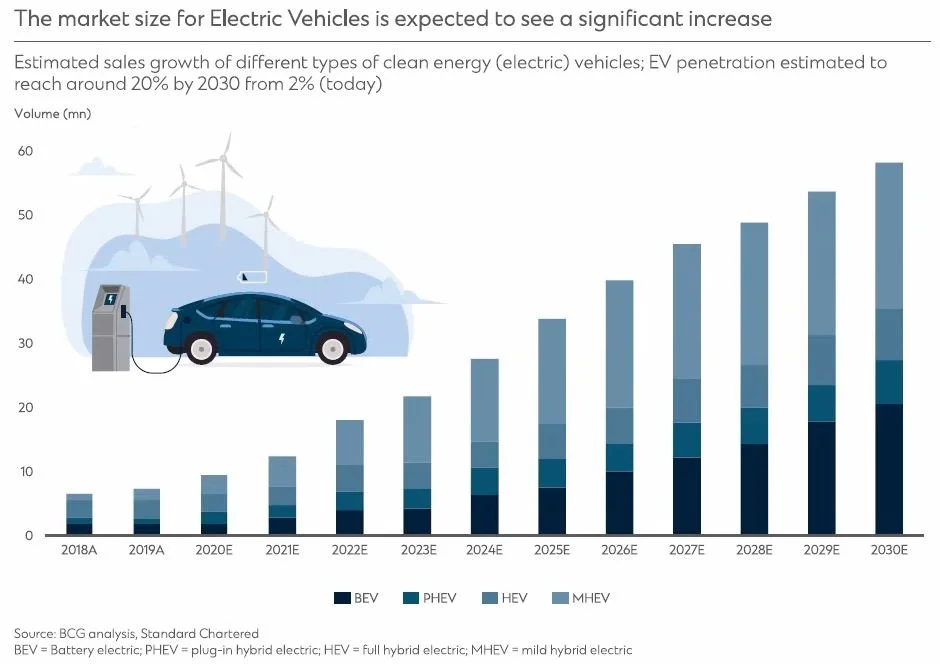

Theme #2 – Electric vehicles (EVs) – kicking into high gear

Although there is a lot of buzz about EVs, it is still a nascent market. EVs represent a slim two percent of market share in the U.S. auto market². Yet there is enormous opportunity for growth, particularly given that more than 20 countries have proposed or implemented some restriction on future use of fossil fuel vehicles. Contributing to the slow start for EV business in the U.S. are technological concerns (such as “range anxiety”) and infrastructure shortcomings (i.e., lack of charging stations). Progress continues to be made, and electric vehicles are expected to make up 20 percent of annual U.S. auto sales by the start of the next decade³. We’ve focused on EV manufacturers such as General Motors, the old Detroit stalwart which, if you look under the hood, has emerged as a leader in EV design and battery technology. In addition, opportunities abound for firms that provide support for the industry. That includes BorgWarner, maker of critical parts for EVs including motors, transmissions, and battery modules. It also includes Orion Engineered Carbons, a producer of specialty ingredients essential to tire manufacturing, a potential growth industry as EVs wear out tires faster due to their greater weight and torque.

Theme #3 – 5G technology and cloud computing – creating a market and meeting growing needs

5G, or the fifth generation of wireless technology, is expected to serve as the backbone for some of the most dominant technological developments that will drive our future. This includes the Internet of Things, artificial intelligence, machine learning, and self-driving cars. With the promise of data transmission speeds 100 times faster than with existing technology and greater performance and reliability⁴, it stands to become a vital engine of economic growth.

Similarly, cloud computing is now well established as a key underpinning of today’s technology-driven society. With the rapid transformation toward doing business through digital means that was accelerated by the pandemic, cloud computing’s role has become even more critical.

There’s also an increasing emphasis on expanding broadband access for 18 million underserved Americans (the actual number is likely much larger)⁵. This will involve significant investment in underlying infrastructure.

We’re capitalizing on a variety of opportunities in this area, including networking powerhouse Cisco; IBM as a major player in hybrid cloud computing; and Qualcomm in the wireless arena. Corning is the top global manufacturer for high tech fiber optic communications, and Oracle continues to emerge as a leader in cloud computing infrastructure.

Theme #4 – Aerospace – taking off around the globe and beyond

Air travel may have taken a hit during the height of the pandemic, but the future is bright for the airline industry. According to the International Civil Aviation Organization, global passenger traffic will outpace the growth in global GDP by 50% per year through 2038. In addition, we’ve entered an era where small satellites are now becoming commonplace in space. The number of satellites in earth orbit is projected to quintuple in this decade⁶. Commercial space travel, as illustrated by Sir Richard Branson, is literally just taking off from the launch pad. A variety of companies offer opportunities in these markets, including the aerospace giant Boeing; Corning for its materials science innovation; motion and control technology leader Parker Hannifin; and Crane Company, a supplier for the aviation and aerospace industries.

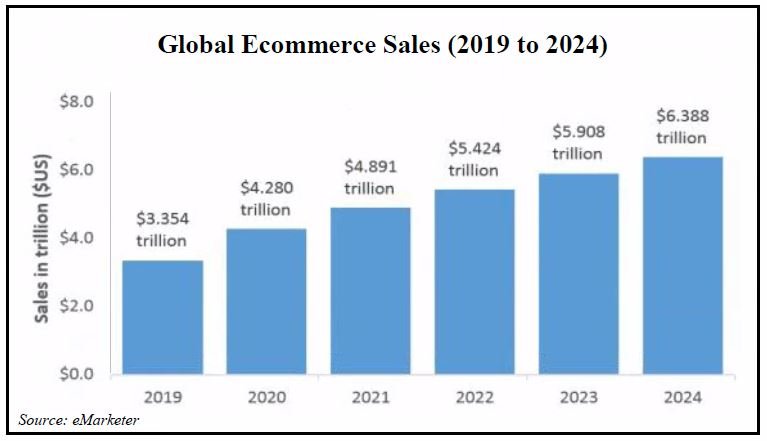

Theme #5 – Online shopping and shipping – the future of retail on steroids

Online shopping (and the shipping business that supports it) was already gaining steam, but the pandemic accelerated business growth. According to the U.S. Retail Index, the economic fallout from the pandemic pushed trends up by five years. Global ecommerce sales are expected to increase by more than 14 percent in 2021⁷. By 2024, online sales may increase by 50%⁷. The more people buy online, the more products that are shipped, which benefits one of our holdings, the global shipping giant FedEx. Before shipping, these products need to be packaged, a benefit to WestRock, a leader in the packaging industry. A prominent, non-Amazon player in the non-traditional retail segment is Qurate Retail Group, owner of home shopping giant QVC and online retail brands such as Frontgate and Ballard Designs.

Theme #6 – Debasement of currency – gold and other “real” assets

Inflation is a real concern for the first time in decades, and with deficit spending running high, accompanied by interventionist actions from central banks around the globe, debasement of currency is a growing concern. This should benefit real assets like gold. Many gold mining companies took on extensive debt a decade or more ago to capitalize on what was, at the time, a boom market in the price of gold. Then prices fell. Today, these companies are in much better financial condition, with strong balance sheets and solid operating margins. In the meantime, gold prices have been strong but appear to have settled in at much higher levels than even just 15 years ago. Gold is positioned to benefit from the global economic recovery, as this element is increasingly in demand for industrial applications. Its strength and tremendous efficiency in conducting electricity, coupled with the growing market for miniaturized technology, makes this precious and expensive metal a more practical choice for a number of industries. Inflation concerns that have arisen are also a historically bullish sign for gold demand among investors. The prominent mining firm Newmont is included in our portfolio. So is the aforementioned Orion Engineered Carbons that is a major player in carbon black, a commodity used in a wide variety of applications.

Theme #7 – Real estate – an appealing asset as the risk of inflation rises

The sudden trend toward higher inflation is likely to have a positive impact on the real estate market. This is especially true of distinctive pieces of property that are difficult to replicate and are in high demand. Unique hard assets found in specific segments of the real estate sector tend to increase in value during inflationary periods. Prime income-producing real estate can also perform exceptionally well in such an environment. Major property players in our portfolio include Simon Property Group and Madison Square Garden Entertainment.

©Robert Weber / The New Yorker Collection/The Cartoon Bank

The future may be unpredictable, but it can be navigated

Our focus on the future and our commitment to building wealth for our clients has never wavered, despite the distractions the world may throw at us. Some mistakenly think that as value investors, we are reluctant to embrace technology or companies with growth potential. Quite to the contrary, we have a tremendous appreciation for growth and innovation. What distinguishes us is that we refuse to pay a premium for companies whose valuation is dependent on earnings that are projected far into the future. We all know that the future is uncertain, and that is exactly why relying on the promise of what may come many years out into the future, without sufficient consideration to fundamentals or valuation, is fraught with risk. As our world continues to undergo change, the constant principles for successful investing remain the same – you must be selective in what you own, and the price you pay for an asset is likely the greatest determinant of investment success.

~MPMG

1Global Infrastructure Hub, Global Infrastructure Outlook.

2International Energy Agency (2021), “Global EV Outlook 2021,” IEA, Paris.

3Goh, Audrey and Iachini, Marco. “How to Play the Coming Infrastructure Boost.” Standard Chartered PVB Thematic. May 2021.

4Federal Communications Commission, “5G FAQs.”

5Federal Communications Commission, “2020 Broadband Deployment Report,” April 20, 2020.

6Ryan-Mosley, Tate, “The number of satellites orbiting Earth could quintuple in the next decade,” MIT Technology Review, June 26, 2019.

7eMarketer, 2021

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.