2023 | Q3 - In Order to Think Outside the Box, you Must Know what’s In the Box

“One cannot understand running water by catching it in a bucket.”

- Lao Tzu, Chinese philosopher

The ability to think differently is a characteristic that’s often celebrated, but a path that few are bold enough to pursue. It’s a topic we’ve touched upon in previous newsletters, and was the motivation behind our choice of presenter at this year’s MPMG Speaker Series event. Acclaimed biographer Walter Isaacson spoke to us just weeks before the release of his highly anticipated book chronicling the life of revolutionary inventor Elon Musk. The celebration of people who built success by following the road less traveled couldn’t have been more timely.

Our society often exalts genius – particularly the genius that drives those who create great things – whether it be art, scientific breakthroughs, or new technology. Isaacson has been drawn to such “genius” in choosing the subjects of his books, including the likes of Leonardo da Vinci, Albert Einstein, Steve Jobs, and Musk. Isaacson shared his insights on the common characteristics of such giants . . . and, surprisingly, intelligence is not the most significant among them. Raw intelligence is not uncommon. The most im-portant attribute, according to Isaacson, was their ability to think differently.

Perhaps at no time in recent market history has it been so important for investors to adjust their perspective, and be willing to step outside of their comfort level and think outside the box. The era of free money, and the speculative investment style that for years benefited from it, has ended. The economic environment and, as a result, the markets, have undergone a tectonic shift. While it may at times be obscured by day-to-day market developments, make no mistake that these shifts are in motion.

Celebrating a different vision

Isaacson regaled our MPMG Speaker Series attendees in August with tales about the trailblazers whose lives he’s chronicled. He noted that many of them share characteristics such as an insatiable curiosity, a willingness to try new things, a passion for their work, and a sense of mission. And they all could, to quote a famous Apple ad, “think different.”

As investors, we resonate with those who can see the world from a distinct perspective and, in doing so, identify creative solutions that were not readily evident to the masses who followed the conventional wisdom. Quite often, what passes for common sense on Wall Street is anything but common or sensible. It takes a unique ability to see past the obvious and find a different approach that can provide a critical advantage to investors.

Many people talk about their ability to think outside of the box. Yet many of these same people fail to appreciate that you first must understand what’s in the box, not to mention the makeup of the box itself.

It’s getting crowded inside the box

Too many investors are caught up in the “macro” view – what’s likely to happen in the economy over the short term and how they should react to those developments. A key challenge with this approach is that too often, forecasts of the macro picture are off base or even dead wrong. It’s entertaining to hypothesize about major events and their possible ramifications, but it is seldom a productive, wealth-creating strategy.

The popular and accepted view of the investment land-scape, certainly dating back to the first interest rate hike by the Federal Reserve in March 2022, was that a recession was forthcoming. Less than a year ago, Bloomberg published this headline – “Forecast for US Recession Within Year Hits 100%” (1). As recently as March 27, 2023, 58% of economists surveyed by the National Association of Business Economics predicted a recession would occur this year2. These predictions have, thus far, proven to be incorrect.

Barbara Smaller / The New Yorker Collection/The Cartoon Bank

In 2023, this “inside the box” thinking that pushed more money out of the market centered on the expectation of economic decline and the potentially negative investment ramifications. The reality ignored by many is that the myriad of factors affecting the markets and economy are far too complex and wide-ranging to predict with great accuracy, even in the short run. Think about how much things change on a day-to-day basis for countries, the global economy, and the geopolitical landscape. The recent unprovoked and barbaric terrorist attack on Israel by Hamas is proof of how unpredictable the big picture can be. A further complication is that it isn’t enough to forecast such unknowable outcomes; one must also anticipate the emotionally driven human response to these events. When it comes to investing, this element is as erratic and unpredictable as anything.

Along with the difficulty in correctly predicting the im-pact of various macro factors on a regular basis, there’s an even more important question. If many investors are in the same mode – in effect, still making investment deci-sions with in-the-box thinking based on the conventional wisdom about the economy, how do you generate an investment advantage? It’s getting very crowded inside the box, and history has demonstrated that it’s the market’s job to prove the majority wrong over the long run.

Market refugees

For more than a decade, investors sought refuge in bonds. Yet the tectonic shift we’ve referred to (spurred by a higher interest rate environment) has turned the bond market upside down. For most of the period from the midst of the financial crisis in 2008 right through 2020, bonds provided reliable stability for investors willing to accept miniscule returns. During this period, global interest rates were at the lowest levels in 5,000 years. But five millennia of history came crashing down in a hurry. For the three-year period ending in September 2023, U.S. bond markets suffered their worst losses in recorded history (going back to 1878) (3). Bond investors are learning the painful consequences of thinking inside the box.

The pain absorbed in the bond market may pale in comparison to the potential risk facing those who view technology stocks as a safe haven. Investors have again turned to many of the same mega-cap technology stocks that drove the market in the pre-2022 boom times, particularly Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla. This flight to the familiar was primarily driven by the sudden enthusiasm for all things related to artificial intelligence (AI).

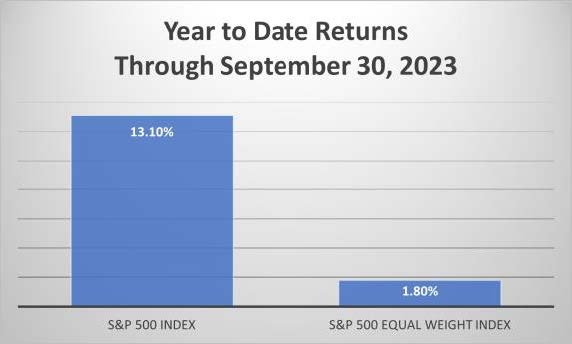

The impact was extreme. Stock market performance in 2023 has been heavily skewed by the sheer weight of these stocks. For the year-to-date period ending in September, the market capitalization-weighted S&P 500 Index rose 13.1%. Historically, investors have viewed the S&P 500 as a proxy for the broader stock market. However, that has not been the case for many years. The almost cult-like following of the seven mega-cap stocks and the continued flow of funds into passive investment vehicles such as index funds and ETFs, have altered the math for the S&P 500. These seven stocks alone represent 29.6% of the capweighted index, what may well be the most imbalanced and top-heavy the index has ever been. (4) The seven mega caps have returned, on average, 92% year-to-date(5), and are responsible for nearly all of the 13.1% return of the capweighted S&P 500. In other words, seven extremely large and popular companies in the S&P 500 Index were up significantly through the September, while the other 493 businesses in the index saw their stock prices, on average, either flat or down for the same period.

Look at the S&P 500 box from a different perspective, and the story changes dramatically. An equal-weighted S&P 500, meaning all 500 stocks are equally represented in calculating index performance, shows a year-to-date return through September of 1.8%, more than 11 percentage points below the headline number investors typically follow. The imbalance of the index persists even though many of the remaining 493 companies in the index are solid, profitable firms with established track records.

Investors should consider whether it continues to make sense to own only a handful of mega-cap, momentum-driven stocks and ignore all of the great companies scattered across the rest of the market. Is this time really different from previous circumstances? As Isaacson noted, too many people are guided by dogma rather than expanding their vision. We’ve seen many examples of this in the investment universe. In the days of the dot-com bubble that burst in 2000, the damage to technology stocks was not short-term in nature. In fact, of the ten largest technology stocks (by market capitalization) in 2000 when the dotcom bubble burst, none outpaced the market over the subsequent bull market that ended in late 2007. And only one of those companies, Microsoft, generated market-beating returns from its peak in 2000 to the end of 20226. This experience demonstrates how choosing the comfort of what’s working now not only fails to offer assurances of long-term prosperity, but also may put your long-term financial security at greater risk.

The narrow group of stocks that prospered in the first three quarters of 2023 thrive not on their current results, but primarily based on the prospects of earnings expected to materialize in the future. These types of equities traditionally perform best in a low-interest rate environment, as (i) the present value of future earnings and cash flows are worth more because they are discounted back to present value at a lower rate; and (ii) there’s minimal competition from low-yielding bonds. That environment no longer exists, and as bond investors have already come to realize, the stock market will most likely rotate as well.

The era of “free money” and extreme suppression of interest rates by the Fed is over. It may not fully be reflected in the market just yet, but history tells us that reality will catch up to significantly overvalued stocks.

Overlooked and undervalued

To this point in 2023, most stocks are flat or down for the year. Yet there’s no reason for investors to experience FOMO (fear of missing out) of the lopsided rally that occurred earlier in the year. Instead, it’s a time to revel in the opportunity that exists by thinking differently and identifying underappreciated stocks that are poised to prosper. As many individuals prepared for the “inevitability” of a recession, they flocked to money market funds at a pace never before seen. More than $6 trillion sits in this historical safe haven, with expectations that the number will climb to $7 trillion in short order (7). This amount of cash on the sidelines, while potentially misguided in the short-term, is a positive sign for the markets. It indicates that many investors have money to put to work in stocks, which could help fuel a broader-based rally.

There are numerous mispriced stocks currently outside the box. It’s not as simple, however, as buying all of those stocks. The key to successful outside-the-box thinking is to find impressive businesses that are truly attractively priced. A careful, thoughtful, and well-reasoned selection process improves the potential to be right more often than the rest of the market. The legends who Walter Isaacson profiled proved that ignoring dogma, asking the hard questions, and challenging the status quo are key to uncovering new opportunities. Many people content to follow the conventional wisdom will be reluctant to change. As Isaacson stated, we live in a time where people rarely get in trouble for saying “no” to unconventional thinking. Yet a willingness to think unconventionally is called for in times like these.

Investors must recognize that we live in a different world today. The forces that existed before interest rates rose dramatically are no longer in place. Future stock market profit opportunities will be built upon the key fundamentals of investment management that ultimately determine investment success.

While outside-the-box thinking can be uncomfortable when powerful forces seem aligned against you, it does help you see past the complacency of conventional thinking and find a true path forward.

~MPMG

Bloomberg.com, Oct. 17, 2022.

Flowers, Andrew, “Why Economists Believe A Recession Is Likely in 2023,” Recruitonomics.com, March 31, 2023.

Source: Ziem Ye, “Worst US Bond Selloff Since 1878 Marks End of Free-Money Era,” Bloomberg.com, Oct. 8, 2023.

4Source: BofA Global Investment Strategy, Bloomberg. Oct. 10, 2023

Ermey, Ryan, The 7 largest stocks in the S&P 500 have returned 92% on average this year – but ‘it’s not terribly healthy’ for markets,” CNBC.com, Oct. 6, 2023.

Research Affiliates, “The NVIDIA/ AI Singularity: Breakthrough, Bubble, or Both”, September 2023.

Wiltermuth, Joy, “When Fed rates plateau, expect these key investors to join the $6 trillion charge into money market funds,” Marketwatch.com, Sep. 20, 2023.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.