2025 | Q2- The age of acceleration

“Life moves pretty fast. If you don’t stop and look around once in a while, you could miss it.”

~ Ferris Bueller from the movie Ferris Bueller’s Day Off (1986)

Technology permeates every part of our daily lives. Sometimes, we fail to appreciate just how dramatically the world has changed, even in our lifetimes.

Anyone who watches the old Andy Griffith Show will see the sheriff picking up the phone and speaking to Sara, the operator. Around the time the show aired, rotary dial telephones were on the leading edge of technology (watch any 1970s movie to see the technology in action). In only a few decades, we hold much more advanced and mobile technology in our hands, speaking not to Sara, but to Siri, to place our calls without even touching the screen.

That transformation is impressive, but in many ways, it pales in comparison to what is underway today. Artificial intelligence (AI), which only a few years ago was considered a concept with no practical applications, is poised to transform the global economy in just a few years.

Progress does not move in a straight line. Consider that it took 100,000 years for society to transform from the Stone Age to an agrarian-based economy. Relative to that, a quicker advancement that still moved at a glacial pace was the transition from a farming-based economy to a steam-driven industrial age, which occurred over a 12,000-year span. It took only 200 years from the start of the Steam Age to today’s AI advancements. Just think of how stunned our nation’s founders, such as Washington, Adams, Jefferson, and Hamilton, would be if they were transported into today’s world. The pace of change is so astonishing that even someone who arrived from the year 1980 would hardly recognize what they see.

© Jack Ziegler / The New Yorker Collection/The Cartoon Bank

Take it a step further. Within our working lives, many of us who once relied on the convenience of a fax machine marveled at the ability to use our phone lines to dial up America Online. Then DSL, and now fiber-optics, make communication more seamless than ever. These changes occurred in less than three decades.

Today, we are witnesses to a paradigm shift, the early stages of a transformational period that’s driven by revolutionary advances in AI. These changes will result in tremendous, economy-driving efficiencies that will change the nature of business as we know it.

Fast gets faster

The pace of technological change is accelerating rapidly. A standard applied to technological development since 1965 is known as Moore’s Law, which states that computing power will double every two years. However, the rapid development of technology has rendered this longstanding rule of thumb obsolete. Based on Moore’s Law, AI chips should have improved 32 times in the past decade. In reality, these chips have improved by a factor of 1,000 in that span.

AI is just one example of how technological transformation is moving apace. For instance, in the energy sector, solar power’s cost per watt today is 99% cheaper than it was in the 1970s. In the health care industry, sequencing a human genome cost $100 million in 2001. Today, that cost is down to $500, a 200,000x price drop in 22 years.

The pace of change has significant investment ramifications. The most notable is the rapid obsolescence of once-dominant technologies. Consider that BlackBerry once controlled more than 50% of the wireless phone market. Today, it is essentially a non-entity. The aforementioned AOL, once considered the gateway to the internet, is irrelevant. We’ve become accustomed to such business evolution, but you should now expect them to come at you even faster!

Implications for investors

The technology sector has long been a favorite hunting ground for growth investors seeking to capitalize on transformational technologies. As we’ve often noted, these speculative investors are frequently willing to pay any price for companies that offer the potential for spectacular profits – even if those profits won’t be fully realized for years to come, if ever. The question now is whether the future profits that growth investors have relied upon in the past will materialize in today’s era of acceleration. The window to build wealth before technological obsolescence occurs is rapidly narrowing. The likelihood of most or all of these momentum-type stock plays ultimately achieving investors’ lofty expectations is decelerating at a faster pace. Waiting too long for actual earnings to occur, as it turns out, may be hazardous to your wealth.

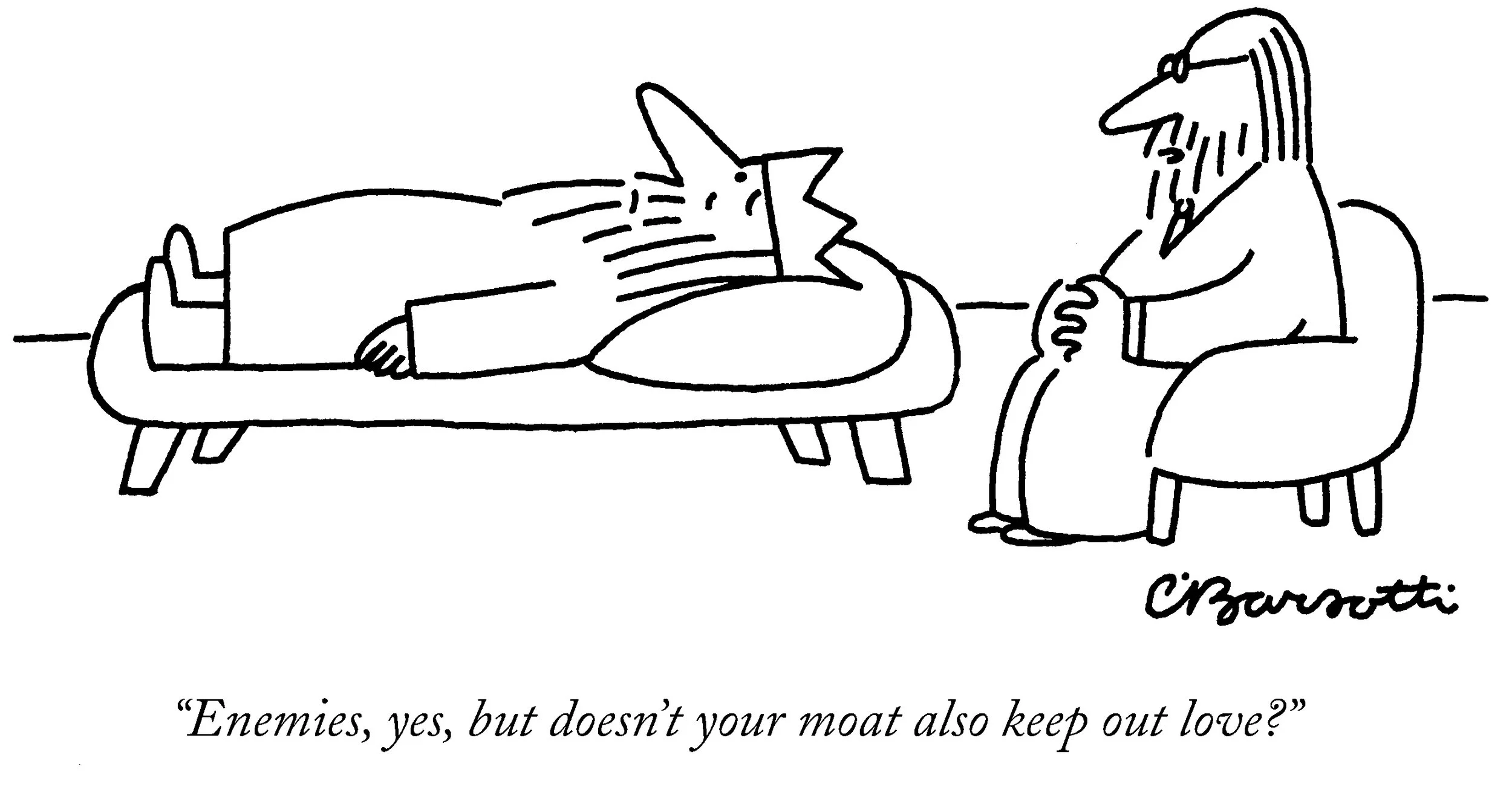

Shallower moats

Savvy investors emphasize owning companies that have nearly insurmountable competitive advantages within their industry. Firms in that position are reasonably insulated from the competition. As a result, these companies are poised to maintain their leadership position, expand their profits, and continue to grow in value. We often refer to companies in such a position as having built a “moat” around their business. In effect, they maintain a line of defense that protects the company’s prospects. With the pace of technological development accelerating, the question must be asked, “Are moats, in effect, becoming shallower?”

© Charles Barsotti / The New Yorker Collection/The Cartoon Bank

Companies that develop new products or technologies may find that if they fail to continually improve their technology, their shelf life may be significantly shorter than it was previously. Firms at the leading edge today, driven by product development, may find their innovations quickly surpassed by newer pioneers who are determined to assume the mantle of industry leadership quickly.

This creates challenges for any investor, but most specifically, growth investors. We’ve written frequently about how the “growth at any price” mentality has been taken to extremes in recent years, driving valuations of select, large-cap technology companies to unsustainable levels. Growth investors are operating on faith that the expensive price paid today for a stock will ultimately pay off in earnings far into the future.

How reliable is that bet today, knowing that the next wave of technological change that could hamper a company’s prospects is just around the corner? Growth investors typically have a heightened risk appetite, but they need to recognize that the risk is even more pronounced today than it was in the past.

Three of the so-called “Magnificent Seven” stocks represent prime examples of companies that are experiencing the impact of shallower moats. Cloud computing is one of the industries that emerged in recent years, with several prominent players – Microsoft (Azure), Amazon (Amazon Web Services or AWS), and Alphabet (Google Cloud). These companies benefited from what’s referred to as “first mover advantage.” Simply stated, it means that those who arrived early with leading-edge technology enjoyed a decided edge over subsequent competitors.

However, the first-mover advantage is another example of a presumed edge being eroded in today’s age of acceleration. In the case of cloud computing, a company that had lagged but put its effort into innovation, Oracle, took the mantle from the big three. Oracle wasn’t a pioneer in cloud computing. Still, it developed a cloud infrastructure that’s faster, safer (eliminating the risk of human error through automation), and yet, more cost-effective for customers. As a result, Oracle drew significant business away from Microsoft, Amazon, and Alphabet. Its innovations are so impressive that Oracle now claims those big three competitors as customers.

Not the end of long-term investing

As windows of profitability based on new technology narrow and moats become shallower, does it mark the end of the “buy-and-hold” investment era? Not at all. To grow sufficient wealth over time in order to meet your ultimate financial goals, being invested in stocks is crucial. However, with the paradigm shift that’s underway, it’s fair to speculate that the era of index fund/Exchange Traded Fund (ETF) investing might become far less lucrative than was the case in prior years.

In the age of acceleration, it’s now more important than ever to be invested in the right companies at the right time. If moats are growing or already sizable, it’s a good time to invest. If moats are getting shallower, it’s a sign that you should consider moving out of a stock.

Index funds and ETFs (most of which aim to track market-cap-weighted indices) now account for the majority of equity fund assets. A major risk is that these indices are heavily weighted toward the largest stocks, which may have already experienced their greatest success. If technologies change or more innovative competitors emerge, which has happened consistently throughout the market’s history, how long can the top firms in the index remain the king of the mountain?

Passive and active share of total equity fund AUM since 2003

As of Feb 15, 2025

Investing in yesterday’s winners seems treacherous as technologies more quickly exhaust their utility. The best long-term investments will be in companies that consistently generate solid earnings, with less reliance on future earnings growth to justify their current massive valuations.

Ask “What have you done for me lately?”

There’s little doubt that continued technological advancements offer exciting prospects for society and investors. The future is coming at us faster than ever before. Ironically, this new age of rapid technological advancement may foreshadow more challenging times for those who traditionally sought to capture future gains by paying exorbitant prices for stocks.

In reality, investors must be more cautious about paying too much for anticipated future earnings. Those far-off earnings may never materialize if today’s “hot” companies, in short order, find that their technology is outdated and customers are moving on to the next big thing.

Now more than ever, investors must understand what they own. As Ferris Bueller might suggest, it’s important to look around and consider the value of whats in front of you today and in the foreseeable future. We live in a world that’s quickly transforming. The long term is getting shorter. Paying too much for a stock in the hopes that it will “grow into” its valuation carries greater risk than ever before. Finding real value will become increasingly critical as we enter a future full of unknowns.

~MPMG