2022 | Q3 - The End of Prosperity??

The Great Depression of 1990

- Title of a best-selling book by Ravi Batra released in 1987. Source

The bleak and spectacularly inaccurate book title referenced above is an all-too-common phenomenon in the annals of economics forecasting. Opportunistic doomsayers come crawling out of the woodwork whenever difficult times occur – such as is the case in 2022. Frankly, we wouldn’t be surprised to see updated versions of similar-themed books given today’s challenging market.

These omens of doom even originate from what many would consider to be respectable institutions. For example, the Central Bank of Ireland recently released a study concluding that “Current young and future generations are…set to face progressively lower standards of living at retirement 1…” The paper centers on legitimate demographic challenges, but in our thinking, falls short in that it fails to account for potential technological innovations that will almost certainly have a positive impact on people’s lives and the underlying economy in the future.

Similarly, some of today’s “doomsayers” lament that the era of “easy money” that prevailed in recent years in the stock market is behind us. They imply that investors need to reduce their expectations – that the prosperity the market generated during this 12 year period is a thing of the past.

©Roz Chast / The New Yorker Collection/The Cartoon Bank

We agree with them only in this regard – the days of making easy money by passively investing in index funds or focusing only on the most popular (and over-valued) mega-capitalization stocks are likely over. This is the result of substantive changes to the underlying economic environment. The most notable changes have been the end of: moderate inflation; a Federal Reserve that manufactured a prolonged period of artificially low interest rates; a federal government that compounded the actions of the Fed through multiple trillion-dollar economic stimulus packages; unabated appreciation of speculative assets including a heretofore unknown asset class called cryptocurrency; and a surge of investors pouring assets into index funds and other passive investment vehicles devoid of judgment or prudence. The markets have reacted to these changes as if the economy has crossed a threshold that will prevent future growth and prosperity. The thinking seems to be that in the absence of the dominant themes of the past 12 years, investors have nowhere to turn.

But does this mean that investors face the end of prosperity? We are adamant in our conviction that this is not the case. Instead, we believe that the secular change that we are witnessing only marks an end to the previous form of prosperity that was built upon a series of narrow, unsustainable, and speculative practices. It’s fair to say that things have changed, but it’s equally fair to define the investment environment of the previous 12 years as out of the ordinary. It rewarded a limited number of stocks to an extreme degree, while leaving most of the rest of the market trailing behind. We are convinced that in the new environment that emerged this year, investment opportunities remain bountiful, more so in fact, because of the market’s dramatic downturn.

The era of opportunity

Much of what happened in 2022 is not a surprise to us. We were right about the likelihood of a major change to the underlying environment (elevated inflation, rising interest rates) leading up to the upheaval in the markets this year. The confluence of unsustainable events listed above primarily worked to the benefit of large-cap technology stocks over the previous 12 years. Buoyed by artificially low interest rates, their valuations soared to unprecedented – and unsustainable – levels.

Yet the party had to end, and as we expected and spilled much ink on in previous newsletters, it came crashing down this year. Many of the “must own” stocks of recent years (Amazon, Alphabet, Microsoft, Nvidia, etc.) suffered significant declines.

What we did not anticipate was that even value stocks would be subject to the market’s indiscriminate selloff. We thought that the much more reasonably priced value sector was better positioned to weather the storm, but that has not yet proven to be the case. The hurricane that swept through the markets, as emotion took over from rational valuations, has battered virtually every asset class. Stocks across the board are now substantially below the levels where they started the year. Bonds are down as well, perhaps more than at any time in centuries, based on some measurements2. Even the so-called, old school “safe harbors” like gold and real estate, and the new school (presumed) safe harbors like cryptocurrency are down.

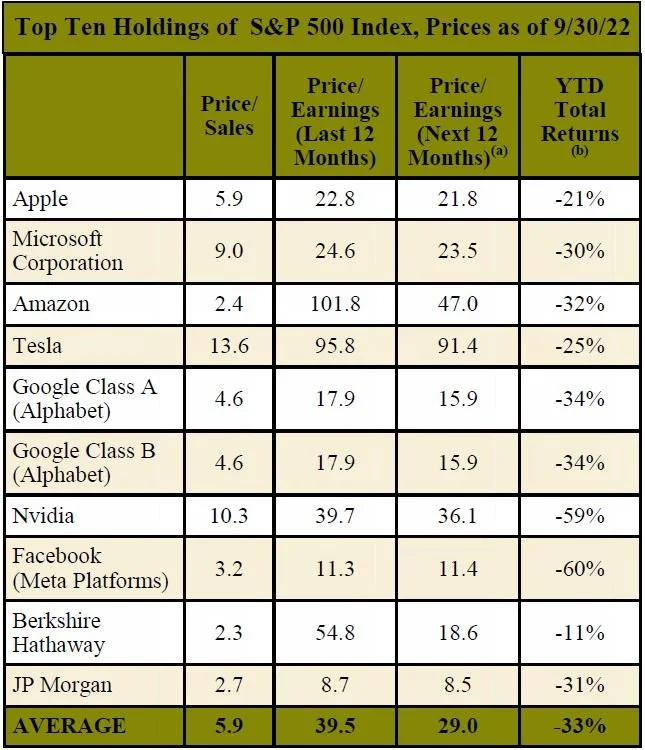

We may have been overly optimistic in thinking that the market’s reaction to the great unwinding of dramatic monetary and fiscal stimulus could leave our holdings unscathed. The net result of the current bear market is dramatically compressed stock valuations for many high-quality companies. This table provides a telling comparison of the top holdings of two groups of stocks, the S&P 500 Index and the MPMG ACV portfolio.

There’s a lot to see here, but the most meaningful numbers are the averages at the bottom of each section. The first group consists of the top ten components of the S&P 500 Index at the beginning of the year. The second group lists the top ten holdings in MPMG’s portfolio at the same time.

The numbers on the far right show that both sets of stocks were down considerably year-to-date through September (-33% for the top ten stocks of the S&P 500 Index; -28% for the top ten in the MPMG ACV portfolio). The relatively comparable investment returns are surprising given that the year began with the top of the S&P 500 Index valued at what we consider to be extreme levels, while our top ten stocks generally retained much more modest valuations. It’s a vivid demonstration of the indiscriminate nature of the market’s wrath, and what we see as an unwarranted correction for stocks with already low valuations.

The rest of the numbers tell a more important story for investors who wonder how to find opportunity in these seemingly dire times. Of specific interest is the stark contrast in today’s valuation numbers on the bottom lines of these two tables. The story is simple – MPMG’s portfolio appears to offer a much more attractive risk/return profile going forward. Both price-to-sales (5.9x for the S&P vs. 1.5x for MPMG) and price-to-earnings ratios (29.0x and 9.9x respectively, in forward-earnings expectations) show a dramatic valuation gap. That tells us the potential downside risk to the biggest stocks in the S&P 500 remains elevated, despite the market’s significant correction. This is especially true given the dramatic change in the economic environment. By contrast, valuations of MPMG’s holdings appear to be significantly compressed, leaving much less downside risk, but considerable upside potential. If the market’s “hurricane” persists, MPMG’s portfolio may still get wet, but we believe that it will likely dry off much faster than the rest of the market as rational pricing returns. More importantly, we are convinced that many of our holdings represent remarkable investments over the long run. The extremely low valuations of our positions represent a truly foundational opportunity for investors to build significant wealth as prices rebound.

Been down this road before

The current, unsettled environment, with high inflation, an aggressive Federal Reserve, and much consternation surrounding the Russia-Ukraine war brings to mind the late 1970s and early 1980s. That was a point when American industry was in freefall – the “rust belt” represented an onslaught of shuttered factories across the heartland, while Japan was supposedly taking over the world. Inflation reached double digits, and mortgage rates were close to 20%. America appeared to be in decline, and the national mood soured further when, in November 1979, American hostages were captured and held in Iran for a year.

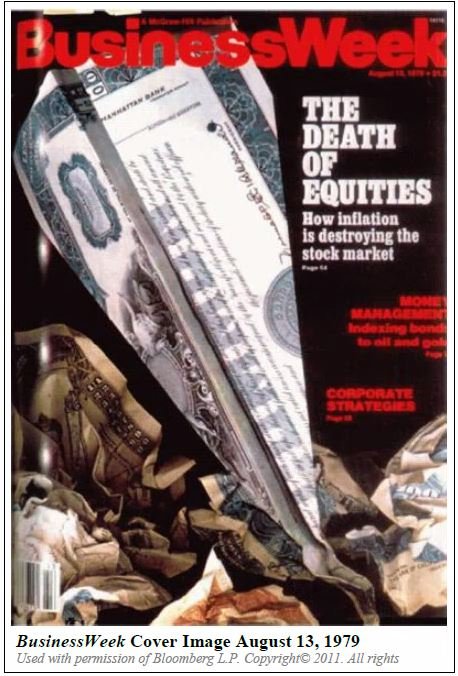

The pessimism of those times was unlike anything the nation had experienced since the start of World War II. In August 1979, Business Week magazine ran its infamous cover story – “The Death of Equities.” We find the folly of this prognostication so absurd that a reprint of this cover, as many who have visited our offices know, resides on the walls at MPMG. It serves as a constant reminder that you can’t get carried away with market sentiment. Instead, it’s important to keep faith in the power of capitalism and how it is reflected in equity market opportunities. The ingenuity that is driven by funding from capital markets leads to tremendous progress, and resolves many of the world’s most complex problems. It creates great potential to build wealth in the process. To profess “the death of equities” or “the end of prosperity” is to question the future of humanity itself.

The Business Week cover story was an overreaction to what, like today’s environment, was a fundamental change in the marketplace – higher interest rates and inflation. Those who ignored the naysayers at the end of the 1970s laid the groundwork for tremendous, life-changing wealth accumulation that many, who were blindsided by the challenges of that decade, missed out on.

Party like it’s 2002

Today’s environment is also remarkably reminiscent of the economy and stock market of 2002. At that time, equity investors were mired in an extended bear market that was triggered by the terrorist attacks of Sept. 11, 2001. That bear market affected stocks virtually across the board. There was no place to hide, and fundamental value was not recognized, as once again emotions became the driving force in the market. Still, it was a major shock to investors who thought a select group of “must own” technology stocks were the key to future wealth. 2003 saw a dramatic change in the investment environment, one where investors came to appreciate fundamental valuation. The MPMG ACV portfolio rebounded strongly, particularly compared against the S&P 500 Index, as rational pricing once again returned to the market.

It is reasonable to recognize parallels between the environment of 2002-2003 and today. Fed monetary policy is normalizing, and interest rates are likely to remain elevated for the foreseeable future. Fast-growing technology stocks won’t have the built-in advantage that existed before with interest rates incredibly low while inflation remained reliably modest. In the previous 12 years, a child could have thrown darts at the top ten of the S&P 500 and come out a winner. That environment is behind us. Today, we have re-entered an era that is more akin to your grandparents’ stock market, – one where fundamental value is a difference maker, and the opportunities for success will require individual thought and no longer following the herd. In this environment, it is less likely that a narrow group of stocks at the top of the S&P 500 will again dominate the market, as was the case in the previous 12 years.

Patiently riding out the storm

Yet many of you are asking, “when will we reach the bottom of the painful bear market of 2022?” It is not possible to provide a precise answer to this question. A year ago, officials from the Fed famously pronounced that inflation was “transitory.” They were wrong then, and the bear market today reflects a lack of confidence in the Fed’s ability to tame inflation without forcing the economy into a recession. There is legitimate worry that the Fed will be forced to continue raising interest rates aggressively in order to counter the effects of the previous policies of unsustainable government stimulus and the printing of money. This risk is not lost on us, and we recognize that the market is susceptible to further, short-term declines.

Yet even the most pessimistic scenarios for today’s environment do not signal “the end of prosperity,” or that future generations are doomed to “face progressively lower standards of living”. History is replete with examples of the marketplace responding to challenges society faces. Consider that back in the 1970s (not that long ago), this newsletter would have been written on a typewriter (maybe a “high-tech” IBM Selectric with a self-correcting ribbon), mimeographed and sent by the mail on plain paper in black and white – no visual elements, charts, or cartoons included. Things changed drastically after that time, not just in word processing, but in computing power, communications technology, medical innovations, and even transportation. Ironically, in Ohio, the heart of the rust belt, Intel recently broke ground on a $20 billion semiconductor manufacturing facility that will not only help reassert the United States as a major technology manufacturer, but also create thousands of jobs.

Investors need to remember that the world, and the financial markets, are constantly evolving, and new opportunities for wealth creation emerge again and again. Our investment approach is more concerned with these future developments rather than if the Dow Jones Industrial Average drops another 1,000 points next month. Our deliberately constructed portfolio is focused on identifying stocks of real value, and in companies positioned to make a meaningful difference in the future. This approach has historically proven to be rewarding for investors who can patiently wait out challenging periods in the market such as we’re experiencing today.

There’s a golden opportunity today to pick through the rubble and find tremendous bargains. History has repeatedly shown that fair valuation is the greatest source of protection against permanent loss of capital. And given the secular change in today’s market, stocks of companies with tremendous future potential, representing incredibly compressed values like those available in our portfolio today, offer a potentially transformative opportunity to build prosperity. As always, but now more than in previous times, patience is key.

~MPMG

1Cine, Simone, “Wealth accumulation and inter-generational inequality with inverted population pyramids,” Central Bank of Ireland, August 2022.

2Sommer, Jeff, “Bonds May Be Having Their Worst Year Yet,” New York Times, Sep. 30, 2022.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.