2022 | Q4 - Lifeboats Are an Afterthought… Until the Ship Takes on Water

“Life on a lifeboat isn’t much of a life. It is like an end game in chess, a game with few pieces. The elements couldn’t be more simple, nor the stakes higher.”

– From The Life of Pi.

2022 is in the history books, and most investors are likely to applaud its conclusion. The challenges that dominated the headlines were well documented – the highest inflation in four decades; the Fed raising short-term interest rates more rapidly than at any time in history; the war in Ukraine, the bloodiest conflict on European soil since World War II; what, by some measures, was the worst year ever for the bond market 1 ; and a catastrophic year for the over-owned, high-flying technology stocks, the very same stocks that before 2022 had driven the markets to record highs. Consider that six of the most prominent technology companies – Amazon, Apple, Alphabet (Google), Meta (Facebook), Microsoft and Tesla – lost a stunning $4.3 trillion in market value 2.

2022 is in the history books, and most investors are likely to applaud its conclusion. The challenges that dominated the headlines were well documented – the highest inflation in four decades; the Fed raising short-term interest rates more rapidly than at any time in history; the war in Ukraine, the bloodiest conflict on European soil since World War II; what, by some measures, was the worst year ever for the bond market1; and a catastrophic year for the over-owned, high-flying technology stocks, the very same stocks that before 2022 had driven the markets to record highs. Consider that six of the most prominent technology companies – Amazon, Apple, Alphabet (Google), Meta (Facebook), Microsoft and Tesla – lost a stunning $4.3 trillion in market value2.

Obscured by the negative headlines that dominated 2022 were some of the astounding advancements that occurred. Perhaps none were more significant than the successful test late in the year to ignite a fusion reaction that, for the first time, required less energy than it produced. The ability to harness fusion technology for any meaningful application, including as a source of clean energy, may be decades away. But this development, already recognized by many as one of the great technological achievements of the past century, moved the fusion energy needle in a significant way – from a pipedream to a very real possibility. It reinforces our belief that the combination of determined effort and creative intelligence can overcome previously impenetrable obstacles.

©Robert Leighton / The New Yorker Collection/The Cartoon Bank

That’s what the future is all about. As investors, it’s always important to consider what’s ahead and in what way you can be positioned to profit from it. Scores of new innovations and developments emerged in 2022. These included breakthroughs that did everything from upgrade the capabilities of artificial intelligence (such as ChatGPT, a newly released artificial intelligence chatbot that is proving to be extremely powerful for everyday users) to medical advances (like drugs that show signs of effectively addressing obesity and Alzheimer’s), and even the FDA sanctioning the production of meat in a lab.

We raise these fascinating examples as a reminder that human innovation is the greatest power in the world. It solves problems and advances society, sometimes in ways that fulfill our hopes; sometimes in ways beyond our imagination. As Henry Ford once said, “If I had asked people what they wanted, they would have said ‘faster horses.’” The change in life from the start of the 20th century (no cars, airplanes, radio or TV, not to mention computers) compared to the end of the century was astounding. Think how much life might change again by the end of the 21st century!

Capturing the opportunity

Society’s advancement through innovation is driven primarily by the power of capitalism. At the heart of our economic system is the ability to identify opportunities of the future and invest in the potential growth of those companies through equity positions. Owning individual stocks is one of the very few, and perhaps the most efficient way that we can think of, for investors to capture the potential rewards that come from companies that create and successfully market new, innovative products and services. Finding pioneering and inexpensively-priced companies that solve the problems of today, while creating the world of tomorrow, is the hallmark of MPMG’s investment approach. Consider some examples found in our portfolio:

Coherent (COHR) and its innovations in the field of lasers, now an almost ubiquitous tool for technology, life sciences and precision manufacturing, among other applications. Lasers are increasingly replacing more conventional technologies due to their ability to perform with greater speed and accuracy.

Corning (GLW) has made significant contributions to a source of some of this year’s greatest discoveries in the cosmos, the James Webb Space Telescope. Corning helped develop three major telescopes that are key to the project;

Boeing’s (BA) new Starliner reusable space capsule, is designed as a cost-efficient transportation solution to take people to and from low-earth orbit, including to the International Space Station; and

IBM’s (IBM) recent innovation, the Mayflower Autonomous Ship, is the first fully autonomous watercraft. It is designed for long-term sea exploration to help gather critical data for scientific purposes. In addition, IBM is the world leader in quantum computing, which will have the power, speed and capability to solve critical problems that are out of reach of today’s most powerful supercomputers.

These are just a handful of examples of how companies in our portfolio are positioned for the future. But the future is only part of the story.

Opportunity PLUS price

Just because a company is innovative and exploring new horizons doesn’t mean that it offers an appealing investment opportunity. The decline and fall of the previously referenced over-owned, mega-cap stocks demonstrate the importance of a selective investment process. In other words, it’s critical to know where to find the “lifeboats” in the stock market – stocks that are temporarily burdened by unfavorable market sentiment, but whose surface blemishes that drove prices lower obscured strong underlying fundamentals. Uncovering such gems has always been the cornerstone of our approach at MPMG, but it is a strategy that, for the most part, has been overlooked since the financial crisis of 2008. Value investors have been challenged by the Federal Reserve’s policy of pumping liquidity into the markets through interest rate cuts and “quantitative easing,” an aggressive program of putting trillions of dollars to work in Treasury and mortgage-backed securities.

In essence, the Fed provided liquidity protection to the market and artificially tempered the ebbs and flows of the business and market cycle for more than a decade. This erased a significant degree of market risk and fostered an extended period of risk taking, as many eschewed selectivity and valuation in favor of chasing momentum and what was “working.” That particularly benefited everything of a more speculative nature, from mega-cap growth stocks to cryptocurrency. In addition, as trillions of freshly-created dollars sought a new home, most investments rose in price with little regard for valuation. In an environment that marginalized fundamentals, passive investing (buying securities that mirror stock market indices) became the rage. The concept of “owning the market” exacerbated the already overvalued state of red-hot technology stocks. This is because the S&P 500 Index is a market capitalization weighted index, and the greater the price and the higher the market capitalization of the company, the greater its share of its composition of the index. So as more money was invested in passive investments, the more these large mega-cap growth stocks swelled in size. This circular process persisted for more than a decade because short term investors saw it “working,” despite the dangerous irony that the more extreme the overvaluation, the more popular the investment became.

The environment of the previous 13+ years came crashing down in 2022, perhaps never to return. Interest rates are significantly higher, a drastic departure from the previous Fed policy of artificially suppressing rates. The Fed is no longer buying bonds and, in fact, is reducing its massive balance sheet. Bond yields today more accurately reflect the underlying economy (one with modest growth, but elevated inflation). This pivot is expected to be an unpleasant development for both the passive and growth investors who thrived in a Fed-fueled easy money era. It changes the investment paradigm.

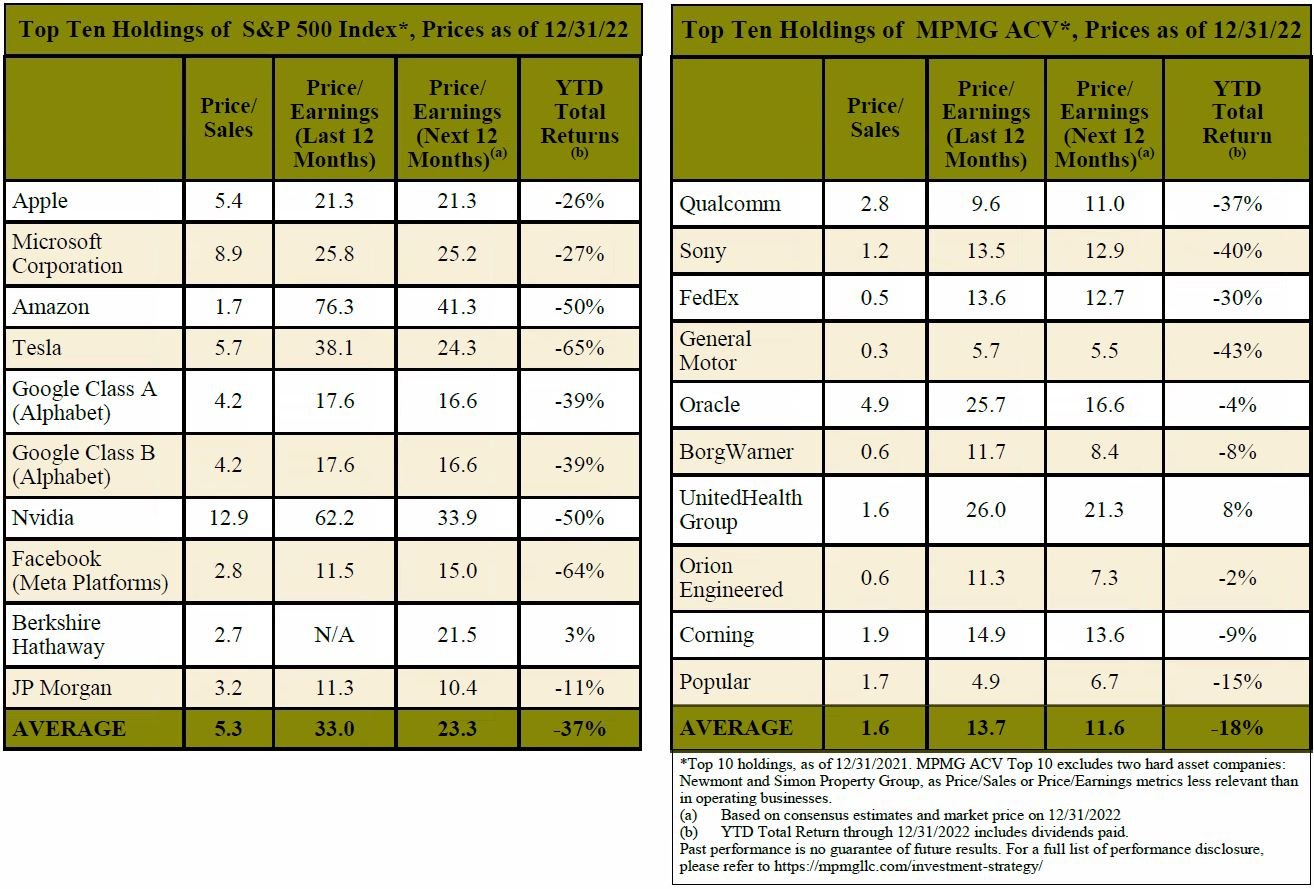

The distinct opportunity and risk profiles for value and growth investors, respectively, are on display in the above data tables. The first table consists of the top ten companies in the S&P 500 Index at the beginning of 2022. The second group lists the top ten holdings in MPMG’s portfolio for the same period.

The negative numbers in the right-hand columns demonstrate the indiscriminate nature of 2022’s down market. Stocks, regardless as to whether they were deemed to be “expensive” or “cheap” by common valuation metrics suffered meaningful losses. But the more important numbers to consider are those that tell us about prospects for the future.

As you review the two tables, consider the price/earnings (P/E) ratios for the next 12 months. MPMG’s portfolio shown here is priced at a 50% discount to the top ten of the S&P 500, and a 30% discount to the entire S&P 500 Index. It’s also notable that another key valuation measure, price-to-sales, shows MPMG’s top ten at a 70% discount to the S&P’s top ten.

While we weren’t able to avoid 2022’s market tempest, on closer inspection, you can see why we did not choose the easy way out and chase what, up until last year, was working regardless of price. We knew that in time, careless speculation would prove to be painful. We never compromised our belief that, ultimately, the price that you pay truly matters. As 2023 begins, this is an important distinction between MPMG and “popular” investment strategies. We believe we are in the infant stages of a return to normalization in the markets, where paying attention to price takes on greater significance.

In our role as active value managers, we find ourselves in a relatively lonely place. As the over-owned, mega-cap stocks continue what we believe to be an overdue and very warranted correction, we stand as one of the few remaining investors with the skill set and discipline to thrive in this “return to normalcy.” The markets’ major transformation occurred when many of our brethren among value managers disappeared altogether. Their departures may have been premature. When interest rates were down, higher stock valuations seemed more justified and were easily leveraged via passive investment approaches. But with rates much higher and likely to stay that way for some time, value and selectivity truly matters once again. With so many professionals departing this segment of the market, there’s tremendous opportunity, with a dearth of investors seeking to capitalize on it.

©Warren Miller / The New Yorker Collection/The Cartoon Bank

Our views over the past year

Much of what we’re talking about above reinforces points we’ve made in our newsletters for much of the past decade and certainly in 2022. In the first quarter (“The Fog of War”), we talked about how the financial landscape was undergoing a major transformation. We noted that the markets reacted negatively in the wake of the war’s commencement, but that the key “fact on the ground” that really mattered was that the era of “free money,” meaning the Fed’s loose monetary policy, was over.

In the second quarter (“Bridge Over Troubled Water”), we talked about how the negative market environment was indiscriminate to that point of the year, punishing both value and growth-style investments. Yet we expressed that there were reasons to be optimistic for the long term – because stock returns have historically outpaced inflation, insiders were buying up beaten down stocks, economic fundamentals remained sound, and the valuation of our portfolio appeared to be especially attractive.

In our third quarter letter (“The End of Prosperity??”), we dismissed the narrative that the good times for investors would be more sparse in the future. To the contrary, we stated our belief that the future for investors was bright. However, the opportunities for prosperity would be found in different segments of the market than was the case for the past 13+ years. We also reaffirmed that opportunities remained bountiful and the favorable positioning of our portfolio that would ultimately reward our investors.

Lifeboats matter

As our title suggests, the presence of lifeboats is often overlooked when the seas are smooth. It’s only when trouble arises that passengers and crew gain a new appreciation for their benefits. Value stocks often follow a similar pattern of being disregarded until they suddenly look very appealing.

Value stocks look particularly attractive when the companies with which they are associated have a true vision for the future. As pointed out here and in previous newsletters, our innovative environment means there is tremendous promise on the horizon. As investors, it’s important to recognize that profiting from this promise is best realized when you pay the right price for an investment. We’re adamant in our belief that recognizing value – the lifeboat of the markets – is where investors need to be if they intend to fully participate in everything the future has to offer.

~MPMG

1 Iacurci, Greg, “2022 was the worst-ever year for U.S. Bonds. How to position your portfolio for 2023,” CNBC.com, Jan. 7, 2023.

2 Grant, Charley, “Tesla, Meta, lead Big Tech’s Value Wipeout,” The Wall Street Journal, Dec. 23, 2022, plus portfolio valuation decline of Microsoft stock.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.