2024 | Q2 - One Day In May

“Out of clutter, find simplicity. From disorder, find harmony. In the middle of difficulty lies opportunity.”

- Albert Einstein

Given this summer’s rapid-fire news cycle, it may be difficult to recall what happened on May 30, 2024. Yet put in perspective, it stands as one of the more remarkable days of the year. Let us jog your memory and recall some notable events.

The day’s dominant headline was a former President's conviction in a New York state court on 34 felony counts, an unprecedented event made even more notable because the person convicted currently leads polling for this November’s Presidential election. On a universal level, it was revealed that the James Webb telescope spotted the two most distant galaxies ever discovered. Closer to home, our beloved, long-beleaguered NBA franchise, the Timberwolves, faced playoff elimination. Though their loss that day brought the season to a close, it was notable that this year, the end came in the Western Conference finals, the furthest the team has progressed in 20 years.

Less talked about, but as important, particularly if you care about building and preserving wealth, was what occurred in the markets on May 30th. The headlines reported a bad day for the stock market, as the Dow Jones Industrial Average dropped 330 points. The iconic Dow, of course, is the most quoted (but hardly the most representative) of the major market indices. It is a price-weighted 30 stock index, meaning that the highest-priced stocks carry the greatest weight. Investors who read the headlines probably assumed their own portfolios suffered meaningful losses. Yet the reality was that the Dow’s May 30th decline was almost exclusively due to the $54 (nearly 20%) loss for one large technology stock – Salesforce.

Before the market opened that day, the software vendor reported strong first-quarter earnings that exceeded investor expectations, and it forecast even higher sales in the year to come. Unfortunately for Salesforce investors, the company’s forecast wasn’t ebullient enough to justify the stock’s lofty valuation (approximately 50x price-to-earnings; 7.5x price-to-sales). Salesforce’s one-day drubbing was enough to single-handedly drive the Dow to a significant daily loss.

©Tom Cheney/The New Yorker Collection/The Cartoon Bank

Yet despite the precipitous declines of Salesforce and the Dow, it was a very good day for the broader stock market. Even as the Dow dropped 1%, New York Stock Exchange advancing stocks outpaced decliners by a more than 3:1 margin. On the typically more volatile NASDAQ Composite Index, advancers outpaced decliners by a 2:1 ratio.1

The significant decline in the Dow, despite broader strength across the stock market, is explained by the high stock price of Salesforce and the Dow being a price-weighted index. Salesforce’s $271 stock price before its May 30th collapse made it one of the priciest and most influential stocks in the Dow and serves as a prime demonstration of just how irrelevant index results can be when one (or a few) stocks can have an outsized influence on the results.

Investors should heed caution, as this issue isn’t exclusively related to the Dow. Many of the most popular indices are extraordinarily concentrated among very few stocks that happen to trade at a significant premium. As we saw from the Salesforce sell-off, the inability to live up to lofty growth expectations can result in pain for investors.

Extreme concentration leads to deceptive market returns

No index is perfect; each has its own nuances that make them both unique and flawed. In an ideal world, a single index would serve as a true proxy for the state of the broader stock market, or the subset of the market that the index seeks to reflect. That’s less and less the case today.

A potential flaw of many of the biggest and most popular indices is that they are market capitalization weighted, meaning that stocks with the largest total value produce the greatest influence on index results. Throughout history, some stocks swelled in size, making up an abnormally large share of the index. Historically, stocks like these ultimately ceded some of their value, eventually reverting to more modest weightings in the index. Investors who bought these stocks near their peak likely suffered meaningful losses.

Consider the S&P 500’s recent stellar returns (up 26% in 2023, up 15% in 2024’s first half). The numbers may be misleading because the vast majority of the returns have been generated by a handful of stocks that dominate the top of the index. While on average, we’d expect the S&P 500’s top ten stocks to make up 20% of the index2, the top ten weighting today is just under 36% of the index’s value. It represents an unprecedented level of concentration in what investors perceive as the market’s benchmark index.3

This is troubling for a couple of reasons. First, too few passive investors likely realize the level of risk to which they are subjected. They may believe they own a well-diversified mix of assets, but given the market’s top-heavy nature, they are over-invested in stocks that have performed extremely well, but as a result, carry significantly more risk than was previously the case.

The second reason to be concerned is the amount of money flowing into passive funds. More assets are now invested in passive investment vehicles such as index funds and ETFs than in actively managed mutual funds. By their nature, passive investors are reliant on the whims of the index. As valuations for top ten stocks continue rising to unsustainable levels, the situation becomes more perilous because more money is flowing into these few stocks, thereby pushing the prices higher. This continues until it doesn’t.

Life in the fast lane….but for how long?

An amazing statistic illustrates the unbalanced nature of today’s market: the combined capitalization of the ten largest S&P 500 stocks exceeds the total market capitalization of all publicly traded companies in the United Kingdom, France, Germany and Japan put together4.

What’s more, most of these same stocks are part of the top ten positions across a number of prominent indices. As a result, each of these indices is now severely concentrated at the top. Consider the case of the massive NASDAQ Composite Index. While the top ten stocks represent more than half of the index, the remaining 42% is divided among the other 2,500+ stocks – the very definition of an unbalanced (and deceptive) index. The performance of these concentrated indices now mainly reflects results generated by the top ten stocks.

Source: Russell 1000 (as of 5/31/24): CFA Institute, “Concerned About Market Concentration and Lofty Valuations? Consider Small Caps”, Daniel Fang. June 19, 2024. Russell 1000 Growth: Finimize, “Russell Index Shake-Up Spurs Major Trading and Portfolio Tweaks”, June 25, 2024. NASDAQ and S&P 500: index fact sheets, as of 6/30/24.

Passive investors are now beholden to indices that are concentrated, highly correlated (the most prominent stocks are primarily technology issues) and dominated by stocks with valuations more than double the market’s historical average. It’s important to heed the lessons Salesforce investors learned on May 30th. As investors establish high valuations (a.k.a., expectations) for stocks, such as we’ve seen with today’s top ten stocks based on cloud computing/artificial intelligence momentum, even the slightest negative surprise can send several stocks down sharply. If the top ten stocks in today’s S&P 500 lost 10% in a single day, it would create a 3.6% market decline, outside of what happens to the other 490 stocks in the index. If, like Salesforce, those stocks collectively lost 20% in a day, the market would be in a 7.2% fall.

The status quo will change

The dominance of a micro-segment of technology stocks dates back to 2009, when the Federal Reserve’s unprecedented quantitative easing policy emerged and added massive liquidity to the markets. These stocks were buffeted by a Fed-induced artificially low interest rate environment, which significantly discounted risk and served as rocket fuel for stock prices. Investors were willing to bid up prices of these stocks based on distant earnings expectations. With the exception of a setback during 2022’s bear market, these stocks have enjoyed such an extended run of good fortune that investors may think the good times will never end.

But history tells us that market leadership consistently changes. In 2000, names in the top ten of the S&P 500 included General Electric (at the time, revered as the best-managed company in the world), Walmart, Intel, Lucent Technologies, Citigroup and Time Warner4. The economy evolves and for some companies, fortunes change. In time, as was the case for these previous Wall Street darlings, most stocks follow a similar, market-driven path of creative destruction. The current top stocks are mostly destined to follow that same path.

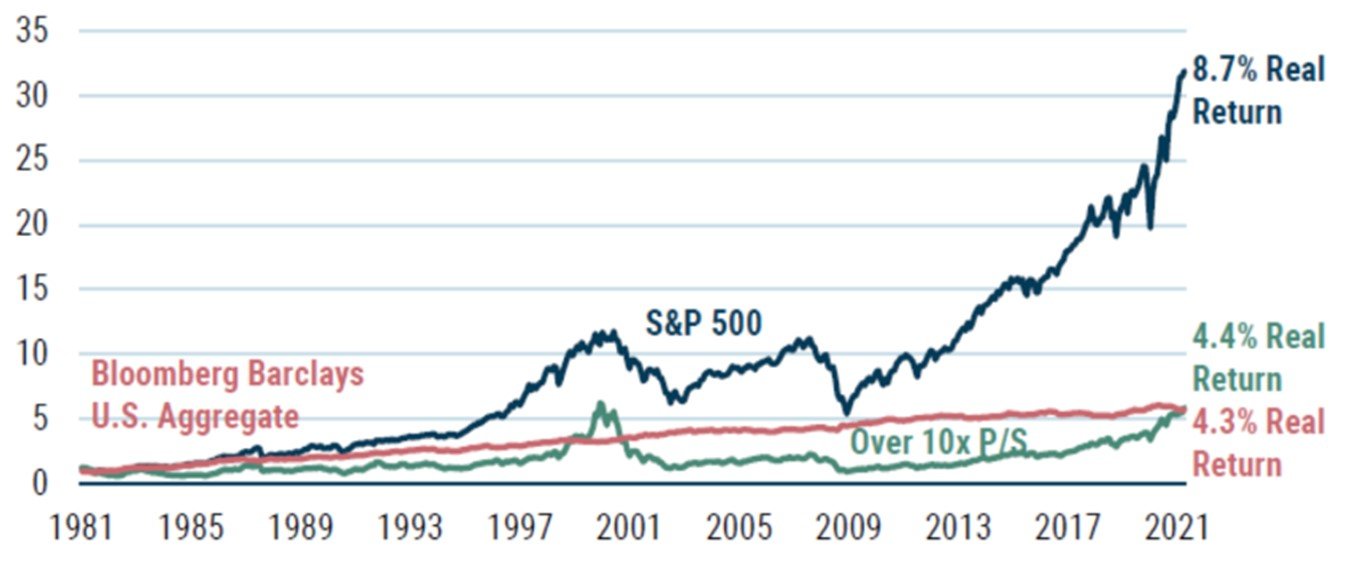

Overvaluation is evident in many ways, but one of the most notable today is the price-to-sales ratio, a metric now reaching frightening levels. This is a barometer of a stock’s price to a company’s revenue stream. The dot-com bubble of the late 1990s and early 2000s stands as a great historical example of a period with excessive price-to-sales valuation. At the time, 19% of the Russell 1000 index had a P/S ratio of greater than 10x 5, a number considered historically risky. The risk was ultimately realized, with a long and severe market downturn, as the stock market (as measured by the S&P 500) lost nearly half of its value between the peak in March 2000 and its trough in October 2022. Today, even more stocks, 22% of the Russell 1000 index, have a P/S exceeding 10x.5 Why does the 10x figure raise red flags? Simply because from a historical perspective, companies reaching that valuation level, on average, significantly underperform the market.

Performance of Stocks Trading at Over 10x Sales, versus Stock & Bond Indices

Source: GMO, Compustat, Standard & Poor’s

Today’s poster child for P/S risk is Nvidia, the AI-chip developer and market darling of the past two years. For most of its history, Nvidia stock traded at approximately 5x sales. Its stock price today is approximately 38x sales! If that number is difficult to put into perspective, consider this. If Nvidia grows sales at what would be an impressive but unlikely 20% per year over the next decade, and ten years from now its price/sales ratio returns to 10x (still considered elevated by normal standards), its stock would earn a paltry return of 5% per year. It appears highly unlikely that Nvidia can sustain its current pace of stock price growth, and worse, is at risk of a major turnaround in fortunes if it fails to live up to current expectations.

Nvidia may be the most flagrant recent example of a stock that has surged in popularity and benefited from the positive feedback loop. But it is just one of many technology stocks that have reached unrealistic valuation levels, by a variety of measures.

©Sarah Kempa / The New Yorker Collection/The Cartoon Bank

Selective investors can avoid today’s risks and capitalize on massive opportunities

Is today’s extreme concentration a potential problem for investors? We contend that the answer is a resounding YES, but not for all investors. The primary risk resides among those who use a passive approach and eliminate value considerations from their mindset.

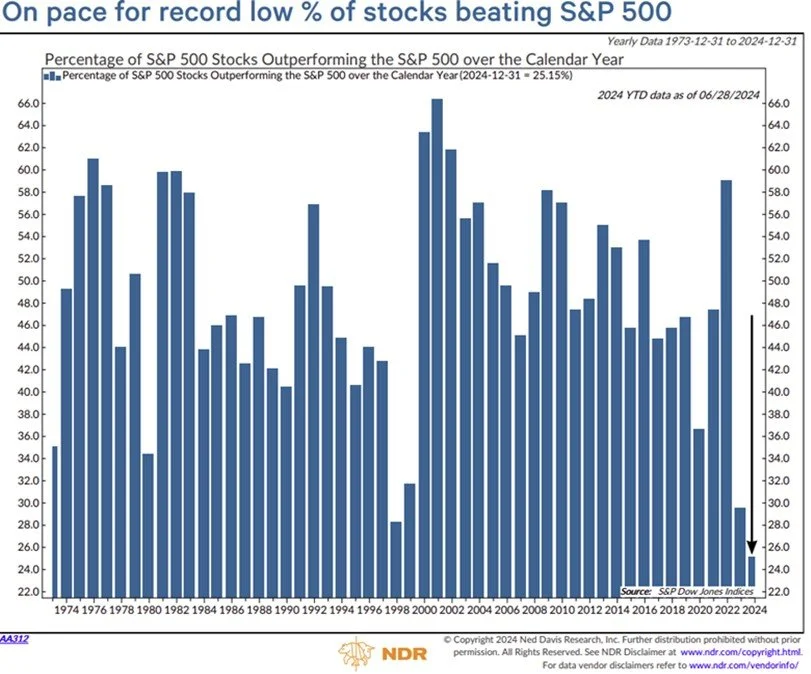

The vast majority of stocks have not fully participated in the market’s 2023 and 2024 rally. In 2023, less than 30% of S&P 500 stocks outpaced the market. In 2024’s first half, about 25% of S&P 500 stocks generated market-beating returns. If that number holds, it would represent an all-time low. In an average year, close to half of stocks beat the market.5 History tells us that the clock is running out on this unbalanced performance that’s been driven mostly by highly correlated stocks with a technology bent. The last time the number of stocks outperforming the index was so out of sync with historical averages was 1998 and 1999, just before the 2000 bear market.6

As investors assess the universe of opportunities, there is a wide range of stocks to consider across a wider range of industry sectors and market capitalizations offering attractive valuations. Because many of these stocks are fairly or undervalued, they carry minimal relative risk of failing to meet investor expectations in the way Salesforce did on May 30th. Along with the significant upside potential of selected stocks, they also have meaningful downside protection, especially compared to the overweighted mega-cap stocks of today.

Passive investors who invest in the popular (and highly concentrated) indices and ETFs may not be able to avoid the inevitable reckoning facing today’s most prominent and expensive stocks. By contrast actively-managed portfolios can sidestep these potential stock market landmines and position themselves in the incredible wealth-creating opportunities as the market begins to regain its balance.

1 Reuters.com, May 30, 2024.

2 GSAM Insights, “Equity Index Concentration and Portfolio Implications,” Nov. 6, 2023.

3 S&P Dow Jones Indices, “S&P 500 Fact Sheet,” June 28, 2024.

4 Morgan Stanley, “Consequences of Concentration,” January 19, 2024.

5 Kailash Capital Research LLC; as of 1/31/24.

6 Source: Ned Davis Research.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.