2024 | Q3- A Diego Story- A tortoise tale that isn’t a fable

“Tortoises can tell you more about the road than hares.”

- Khahil Gibran, writer, poet, philosopher

MPMG clients are familiar with how we value the tortoise as a symbol of our investment approach. But we promise not to dwell (too much) on the Aesop’s tortoise and hare fable on which our symbol is based. No, this letter instead celebrates the incredible story of a real-life Galapagos Island tortoise named Diego. Amazingly, this more than 100-year-old tortoise’s life offers lessons for us all, particularly given the turbulent times in which we live.

Diego, was born in the Galapagos and, shortly after World War II, while still young, was captured and brought to the San Diego Zoo. However, he ended up back in the Galapagos as part of a breeding program designed to help re-populate the endangered species of the Hood Island tortoise. At the time of his return, the situation was grim. Only 15 such tortoises remained in existence, with most of its population wiped out by whalers in the mid-19th century. Diego entered the scene facing a dire situation and carrying the burden of being the species’ best hope for survival.

Diego the Tortoise

And yet through perseverance and determination, Diego, with the help of numerous female companions, answered the call – again and again. Over decades, he fathered more than 900 offspring, most of whom were ultimately released into the wild. As a result, the population of Hood Island tortoises has expanded to a healthy 2,000. The breeding program proved so successful that it has been discontinued. Diego was retired from service and released back into the wild to live out his years (which may yet be many) in peace.

We recognize that this is an investment newsletter, so you may be asking yourself what prompts us to kick off this issue by reporting on the reproductive attributes of a rare tortoise. We think Diego’s story serves as a telling metaphor for how investors should approach the markets. We see significant similarities between the approaches of tortoises and value investors:

#1 – A built-in fortress, prepared for anything

Despite their notoriously slow-moving nature, tortoises have little fear of predators. Most notably, their hard shells make it difficult for any other creature (outside of humans) to do much harm. By contrast, hares are particularly vulnerable, offering little in the way of defense outside of their speed. Value investors have their own shell of protection. By not overpaying for a stock, focusing on the quality of the business, and ensuring it has a clean balance sheet, investments are less susceptible to downside risk than most stocks. In essence, its approach serves as a shell against the market’s slings and arrows. Value investors proceed with the confidence that their portfolios can withstand such volatile times. Growth investments, not unlike hares, are more vulnerable. Their premium valuations make them susceptible to meaningful declines when threats arise or when market conditions become unfavorable.

#2 – Proceeding deliberately

Hares are not known for moving at a measured pace. They scamper erratically from place to place seeking out quick morsels to munch, always looking over their shoulders, rarely staying in one place for long. It reminds us of momentum and growth-style investors who restlessly scamper for the next easy pickings. Their methodology often lacks discipline or consideration for risk. By contrast, we value investors follow a more deliberate approach – identifying attractive opportunities for long-term capital appreciation and not allowing the market’s “noise” to distract us from our ultimate objective. We anticipate what’s ahead and change course if needed, looking at turbulent markets as prime opportunities to find new investments at more favorable prices. Like the tortoise, we move deliberately and purposefully towards our objects.

#3 – A focus on longevity

Tortoises take the long view for a good reason – their protracted natural lifespan. Diego is already more than a century old. By contrast, a typical wild snowshoe hare lives no more than three years, and often doesn’t see its first birthday. This is apropos of the differences between value and growth investors. Typical growth investors seek to ride the market’s momentum while it’s favorable, oftentimes exposing themselves to risk when that momentum ultimately moves against them (see their experience during the dot-com bubble of the early 2000s for an example of a disaster waiting to happen). By contrast, a value investor views the market the way the tortoise looks at life, with a long lens. Diego’s prolific life is the personification of the power of compounding. The combination of time plus perseverance plus progress resulted in an incredible return for the breeding program. For value investors, there’s little concern for immediate gratification. Rather, the focus lies in protecting existing wealth and prudently seeking the best opportunities in order to achieve prolific gains, leveraging the power of time and compounding to make it happen. It’s also a recognition that wealth carries on, not just for a lifetime, but often across generations.

“The four most dangerous words in investing – ‘This time it’s different!’

This famous quote from legendary investor Sir John Templeton seems particularly appropriate for the times. Numerous investors are experiencing considerable angst and anxiety over today’s seemingly unprecedented world circumstances. The distractions and challenges are many. We’re still feeling the aftershocks from a period of high inflation that resulted in significant affordability challenges, causing many Americans to feel acute financial strain. The federal government faces record debt and deficits. Annual interest payments on the federal debt now top $1 trillion, which exceeds the soaring national defense budget. There are increasing questions about the dollar’s status as the world’s reserve currency. Our nation remains politically polarized, evidenced by the toss-up status of this year’s elections and extreme political vitriol beyond anything we’ve seen in recent times. Geopolitical crises are underway across the globe, from the Middle East to Eastern Europe to Africa. Developed countries face troubling demographic issues with declining birth rates, which has significant implications for ongoing economic expansion. On top of these mostly man-made challenges are natural disasters. The tragic damage left in the wake of Hurricane Helene and Hurricane Milton is heartbreaking. It also highlights the heightened risk of natural disasters: the aftershocks resulting from technological disruption to our increasingly connected world are widespread, and the soaring costs to rebuild and replace ravaged assets due to lingering inflation can be staggering.

©Alison Wong / The New Yorker Collection/The Cartoon Bank

The laundry list of challenges represents just a handful of investor concerns. These concerns are very real, and we empathize with those who are struggling. Yet we’re firm in our belief that it doesn’t mean investors lack real opportunity for profit. Crises have always been with us. You only have to go back four years, when the global economy virtually shut down in the early days of COVID-19. The terrorist attacks of 2001 came amidst a recessionary period and the dot-com bubble bursting. In the 1980s, America was on alert for “Japan taking over everything.” In the 1970s, OPEC flexed its muscles, creating a worldwide energy crisis.

These were all new developments at the time they occurred. All opened the door to the possibility that everything could change for the global economy and investors. That left investors questioning whether it was still possible to experience prosperity in the future as we had in the past.

Yet one thing has been constant over these decades where events threw us into a world of the unknown – it was always possible to identify investment ideas that work. From 1970 to 2024, the S&P 500 generated an annualized return on nearly 11%. Numerous “red flag” events could not deter the power of staying invested.

Source: Bloomberg, First Trust Advisors L.P., 12/31/1969 - 3/28/2024

It is in times of uncertainty and volatility that the groundwork is often laid for significant wealth accumulation. Investors are well served to develop a hard shell and let chaos rain around them while maintaining a patient, deliberate approach. Owning the right businesses temporarily available at bargain prices is how fortunes can be made amidst turbulence.

No matter how different “this time” may be, history tells us it doesn’t alter the general trajectory of equity market wealth accumulation.

But, the election?

The election is likely to overwhelm headlines in the near term. Clearly, there are distinct policy and personality differences between the major party Presidential candidates. Whoever is elected, there will be consequences on everything from tax laws to foreign policy. Investors will certainly try to parse what the outcome means for the markets. Yet it’s important to acknowledge that innovation, ingenuity, and the basic functions of capitalism have always spurred investment opportunity, regardless of the political environment. Even amidst bad policy, good businesses can thrive and create meaningful wealth.

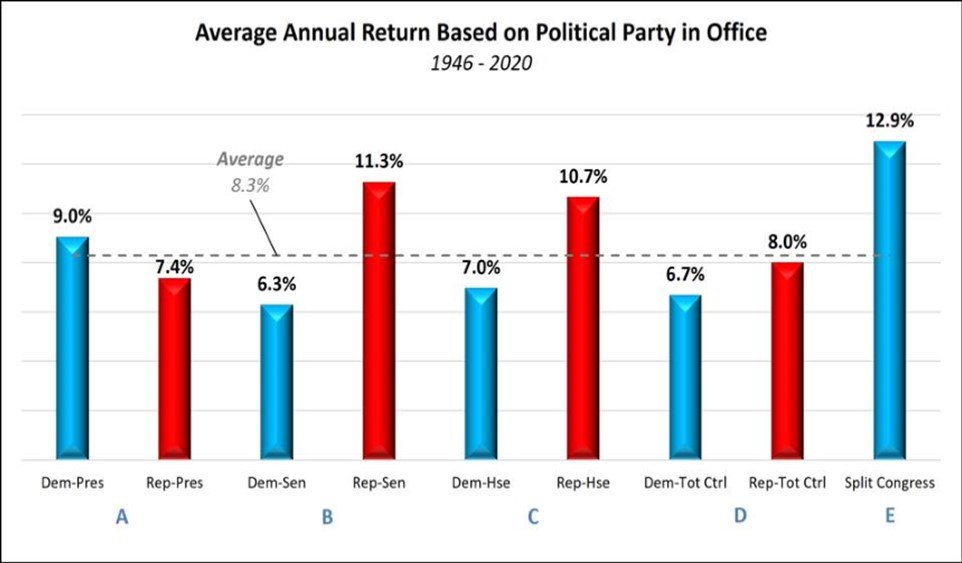

The post World War II record shows that investment returns vary little based on the party in power at the federal level.

From 1946 through 2020, Republicans held the White House 53% of the time, versus 47% for Democrats. Democrats have controlled the Senate and House 63% and 68% of the time, respectively. Performance variations of the Dow Jones Industrial Average have not been too extreme under each of these scenarios. Interestingly, the best performance of the Dow Jones has place under a split Congress, though such a scenario only occurred 16% of the time1.

We believe that the key takeaways from this data are twofold. First, there are far too many variables at play to deem one political party as conclusively better for the market than the other. Second, one party and its policies do not appear to have demonstrated to be destructive to wealth creation.

©David Sipress / The New Yorker Collection/The Cartoon Bank

Uncertainty is overrated

Uncertainty about the survival of the Hood Island tortoise population was at its peak when Diego first stepped in. Few could have envisioned his ultimate success. Yet through a slow and deliberate process, Diego far exceeded expectations. Undeterred and undisturbed by his environment, Diego remained focused on the primary objective and delivered amazing results.

The old bromide that “the market hates uncertainty,” overstates reality. Uncertainty, in fact, opens the door to opportunity for savvy investors. Good values emerge during volatile times. Through a careful research process, we can identify stocks priced in a way that tilts the odds in our favor. Focusing on stocks that offer significant value provides that important “shell” of protection that helps us ride through the market’s most challenging scenarios.

This isn’t always easy. Investors need to go further than simply making the right investment moves. They also need to stick with them even when challenging circumstances mount. Today’s market doesn’t make it easy, but we know there’s nothing new about challenging circumstances. The markets over time, have proven profitable despite a wealth of domestic and global difficulties. To prosper, investors need to be steadfast in their approach, following Diego’s example.

1 Patton, Mike. “Stock Performance And The Political Party In Power: An Historical Look at the Past 75 Years.” Forbes, Jan. 12, 2021.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.