2024 | Q4- A return to normalcy

“Ring out the false, ring in the true.”

~ Alfred Lord Tennyson from his poem, “Ring out Wild Bells”

The dawning of a new year is as opportune a time as any to pursue new habits with the goal of achieving notable life improvements. Often, this means significantly changing your approach to daily living, such as exercising more, improving your diet, or saving more money toward your most important goals. But amidst all these ambitious plans for change, might we suggest a novel, 2025 resolution – embrace a lack of change and a return to the way things used to be.

The past 15 years have been defined by a lack of normalcy in the financial markets. Many investors developed questionable habits over this time. This can be excused, as they found themselves residing in an abnormally stimulated financial world, that included unprecedented economic conditions:

- The Federal Reserve artificially suppressed interest rates with its zero-interest rate policy and four separate rounds of massive quantitative easing initiatives.

- At the same time, fiscal stimulus (sanctioned by both political parties), boosted consumers’ pocketbooks with lower taxes and government-sponsored checks.

- Together, this deluge of “free money” contributed to the highest inflation that we’ve seen in four decades and to record federal deficits. A significant amount of this “free money” is still sloshing around the financial system.

- In the meantime, the Fed misjudged the onset of higher inflation as “transitory,” and was late to the game in raising interest rates. As a result, the Fed was forced to implement interest rate increases at a record pace. Unfortunately, this rapid increase in interest rates had the unintended consequence of putting several poorly managed regional banks out of business in early 2023 and spooking the stock market.

- The technological and legislative developments (namely, the removal of “The Uptick Rule”) that allowed algorithmic trading to flourish (it makes up close to 75% of the trading volume on US exchanges)1 , and the proliferation of passively managed index funds, have both contributed to a highly imbalanced stock market with extraordinary volatility.

© Kim Warp / The New Yorker Collection/The Cartoon Bank

In this post-2008 world of financial abnormality, investors found it too easy to abandon their disciplined practice of identifying underappreciated businesses whose stock prices were well below their fundamental intrinsic values. Instead, many investors succumbed to their emotional need to ride the market’s momentum and fervently accumulated shares of even the most overvalued stocks, further exacerbating the market’s imbalance.

Remembering what normal feels like

Ultimately, the market axiom that trees don’t grow to the sky will apply to the prevailing market environment. The conditions that drove a narrow group of stocks to unforeseen heights are, in the long run, unsustainable. In fact, signs of a return to normalcy are rapidly emerging:

- The Fed is now unwinding its drastic 2022 and 2023 rate hikes, but much more gradually than the market originally anticipated. This more measured and moderate interest rate adjustment period is consistent with a normalized (as opposed to stressed) environment.

- The Fed has also retreated as bond market buyers, reducing its balance sheet from a peak of near $9 trillion to less than $7 trillion.

- Inflation is under control, at least for now, though it will be closely watched as the Fed likely learned from recent history. That probably means the Fed wouldn’t hesitate to raise rates again if living costs jump.

- Not only are interest rates floating freely, but also the shape of the yield curve (which shows the different yields on government bonds of increasing maturities) has moved from “inverted” to its normal, upward-sloping shape where long-term rates are higher than short-term rates. Until recently, the U.S. Treasury yield curve was inverted for the longest period in history – 793 days.

- Government debt will continue to be a major concern, but fortunately the leadership of both political parties acknowledge the severity of the issue.

- One of the most contentious presidential elections in recent memory is now behind us.

- The once tight labor market is showing signs of relief as job openings return to more normal levels.

- Index fund investors find themselves in a uniquely vulnerable position given the S&P 500’s top-heavy nature, pushed to the edge by a narrow band of excessively valued stocks.

Based on historical standards, today’s economy may be headed to as “normal” a state as we’ve seen for some time. The impact of previously implemented artificial stimulation is fading away. Successful investors will continue to focus on opportunities tied to humanity-altering innovations, a hallmark of the new millennium. However, they will quickly rediscover that great businesses only become great investments when they are acquired at a reasonable price.

© Kaamran Hafeez / The New Yorker Collection/The Cartoon Bank

Does the abnormal market have an end date?

In recent years, the abnormal mentality that overtook the market in the 21st century came to a head when a narrow group of high-flying technology mega-cap stocks, now referred to as the Magnificent Seven,2 became dominant drivers of a highly unbalanced S&P 500. In fact, these seven stocks account for about 33% of the weighting of the entire S&P 500 index. 3

As of 12/31/24

As a result, most of these stocks have valuations (as measured by price-to-earnings ratio) exceeding that of the already highly valued broader index. The valuation differential between the Magnificent Seven and the S&P 500 Value Index, a modest proxy for the MPMG All-Cap Value portfolio, is even more pronounced.

The seven mega-cap companies in this listing account for nearly $18 trillion of the S&P 500’s $50 trillion+ market capitalization, roughly double the Fed’s balance sheet at its peak. It’s not easy to comprehend just how much $18 trillion represents. Consider that if instead of dollars, we spoke of 18 trillion seconds, that is equivalent to more than 570,000 years! In other words, a timespan that far pre-dates man’s existence on earth.

The market’s unhealthy imbalance was on full display in 2024. These seven mega-cap stocks accounted for more than half of the S&P 500’s annual gain of 25%.4 Stocks managed a modest gain since the November 5 election, but over 96% of the return since that time is attributed to the Magnificent Seven stocks. Most of the S&P 500 is down during that period, only exacerbating the imbalance.4

The markets are working through these return to normal economic conditions. After a robust year through November, investors appeared to be calculating that the market got ahead of itself. In December, equity markets suffered negative performance across the board. For the first time since 1974, the Dow Jones Industrial Average experienced 10 consecutive days of decline. It culminated with a more than 1,100-point loss on December 18th, as the Fed announced its lowered expectations for 2025 interest rate cuts. The Dow rebounded briefly after that, but markets continue to encounter headwinds.

A time for New Year’s “weight reduction”

As Mark Twain once said, “history never repeats itself, but it often rhymes.” The reversion to today’s more normal economic conditions is reminiscent of the period from 1974 to 1983.

In the 1960s until 1974, large-cap stocks dominated the markets. This was the era of the Nifty-Fifty stocks, the “must-own” popular stocks of that era that, legend had it, belonged in every portfolio. The stock market was wildly unbalanced, with a narrow group of mega-cap stocks dominating the top of the index. The bottom fell out of the stock market in 1974, with the leading name-brand stocks being hardest hit. But the subsequent recovery was anything but widespread. From 1975 through 1983, smaller stocks dramatically outpaced these name-brand stocks. Investors adjusted to a new economic environment that persisted for an extended period. This included elevated inflation and escalating interest rates, which became the status quo.

What has worked during the economy’s recent abnormal times is not destined to keep working well given the environment’s more normalized conditions. Just as in 1974, a changing of the guard may be underway. While large-cap stocks dominated the markets in 2023 and 2024’s first half (as well as most of the past decade), markets demonstrated greater balance in 2024’s second half. The market’s recent top-heavy leaning also left value stocks behind. The tilt in growth stocks’ favor has reached unprecedented levels. It’s another example of today’s market imbalance. If history is any guide, it also reflects that value stocks are well-positioned for a recovery of historic proportions.

Is the stage set?

The market cycle’s slow shift demonstrates a growing recognition of the importance of valuation over momentum. Ultimately, the return on an investment is directly correlated to the price paid for the business. Investors need to be cognizant of the important role valuation plays. While the exact timing of such a shift in investor sentiment can’t be predicted, it’s fair to say that we’re closing in on a point when investors will be ready to squeeze the excesses out of the market and put more focus on value. The most successful stocks of recent years are expensive not only from a valuation perspective but also from the potential for earnings growth, based on current projections.

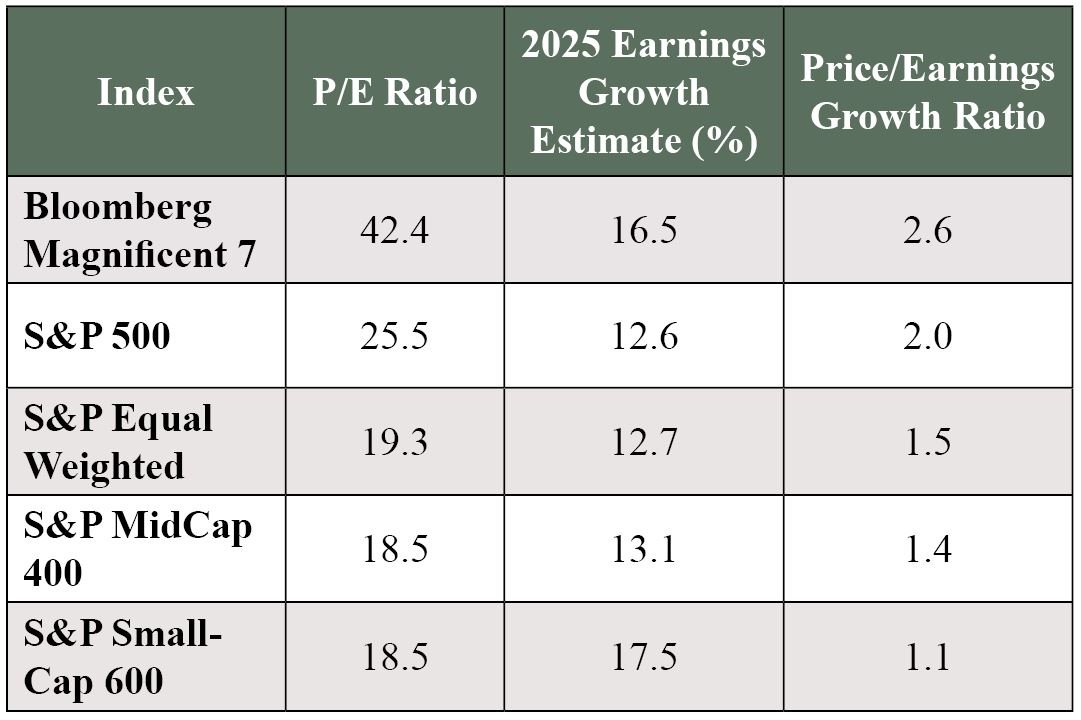

The following table shows that small and mid-cap stocks have the most reasonable valuations (P/E ratio). They also offer significant earnings growth potential in 2025 compared to their large and mega-cap peers. These two figures account for the column shown on the right-hand side, the Price/Earnings Growth (PEG) ratio. This measures how the current P/E ratio stacks up to anticipated earnings growth. The lower the PEG ratio, the more attractive the future investment opportunity. This data shows a clear advantage for small and mid-cap stocks. Note that while projected earnings growth for Magnificent 7 stocks remains strong, current valuations show an excessive PEG ratio, which is a warning sign that these stocks, like trees, can’t grow to the sky.

As of 12/11/24

Investors today have a rare opportunity to capitalize on what may be today’s best value opportunities in small-cap stocks. Many outstanding small, but established, businesses are being ignored by the largest Wall Street firms’ research analysts and are not part of today’s most popular index funds or exchange-traded funds. As the data above shows, well-positioned smaller companies offer more enticing growth potential and, as a bonus given today’s market, much better value than today’s popular mega-cap stocks.

It’s an example of why “weight loss,” from an investment perspective, offers better future growth potential. As 2025 begins, investors need to think smaller.

The year that was

2024 ended as another positive year for equity investors, and as we pointed out here, signs that the market is in the process of undergoing a leadership change. In our newsletters this year, we tracked multiple developments and issues that came to the forefront.

In the first quarter (“The New World”), our focus was on the rapid rise of artificial intelligence (AI). While the conventional wisdom was that a handful of infrastructure stocks would be the major beneficiaries of the rapid increase in AI-related spending, in fact, the upside would be much more widespread. Specifically, we encouraged investors to be open to much more value-oriented opportunities among companies that will determine ways to implement AI, and ultimately, that’s where the real profit opportunities lie.

In the second quarter (“One Day in May”), we highlighted the threat of extreme market concentration. Specifically, we noted that market capitalization-weighted indices, like the very popular S&P 500, when they become unbalanced as they are today, create undue risks for unwary passive investors. Once again, we extolled the virtues of taking value into consideration when it comes to building and preserving wealth for the long run.

Our third quarter letter (“The Diego Story – A Tortoise Tale That Isn’t a Fable”) recounted the history of a prolific Galapagos Island tortoise named Diego, who played an outsized role in saving his species from extinction by fathering hundreds of offspring. We saw Diego as an inspiration for investors, who maintained a solid shell of protection, lived life in a deliberate manner, and, as is custom for tortoises, was all about longevity.

The long-term starts today Investors are at a crossroads. A range of variables could send the market in different directions – from the new administration’s economic policy changes to the Fed’s read on the economy, to a sudden turn in investor sentiment. It impossible to anticipate the market’s short-term, emotion-driven gyrations with any precision. As a result, we are here to make sure that your money is positioned in a way that can capitalize on true value opportunities the market has to offer, without taking unnecessary risks. It’s a time when investors who take a prudent approach, focused on identifying value combined with business opportunity, will be best positioned to prosper.

As the market continues its transformation to “normal,” investors need to be prepared for anything in the short-term, while staying focused on emerging long-term opportunities. We remain convinced that those opportunities are most evident in the value segments of the market that were left behind by the unusual economic and policy circumstances that characterized the past 15 years. Welcome back to normal.

1 Groette, O. (2024, April 7). “What Percentage of Trading is Algorithmic? (Algo Trading Market Statistics)”. www.quantifiedstrategies.com

2 Meta, Alphabet, Tesla, Nvidia, Apple, Amazon, and Microsoft

3 Rosen, P. (2025, January 6). “Big tech is so dominant the stock market would be flat for 2 years without it”. www.inc.com.

4 Towfighi, J. (2024, December 31) “Stocks just did something they haven’t done in nearly three decades”. www.cnn.com.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.