2025 | Q3- The best time to plant a tree…

“The best time to plant a tree was 20 years ago; the second-best time is now.”

~ Old Chinese Proverb

The first three quarters of 2025 represent a truly remarkable time in equity markets. Initially, markets experienced a significant rally following the November election. Then, investors were hit with one of the most rapid corrections in recent history, exacerbated by “Liberation Day” on April 2nd as unprecedented tariffs were unleashed on global markets. After falling nearly 19% in less than two months, the S&P 500 quickly recovered the ground it lost, then proceeded to repeatedly set new records, as it reached new highs.

The market benefited from better-than-anticipated economic data and waning concerns about a full-blown trade war. This level of intense volatility is usually spread out over years, rather than a few quarters. Such a noisy environment, however, may have drowned out the market’s more critical signal.

© Benjamin Schwartz / The New Yorker Collection/The Cartoon Bank

Following more than a decade during which investors placed little value on discerning quality, everything is suddenly different. No longer is the market driven solely by the most popular stocks. At long last, individual thought and selectivity are again in vogue. We see this in the performance of the carefully crafted MPMG portfolio (the All Cap Value Composite), which is up nearly 25% through the first three quarters of the year1 , outperforming general market indices. By embracing a philosophy in which we fiercely believe, those investors who were patient with us are now being rewarded.

The MPMG philosophy would be worth little without the trust and patience of our loyal clients. In recent years, you’ve heard us repeatedly warn that the largest stocks driving the market’s performance were reaching unsustainable valuation levels, and that eventually the markets would recognize more attractive opportunities in value-oriented stocks. Many of you took us to heart. In 2025, your faith and trust have been rewarded. MPMG’s value-based philosophy is built on finding unique businesses that are mispriced and often out of favor compared to popular, high-flying stocks. Our research and judgment are essential, but without your patience and trust, the MPMG philosophy would be akin to the Betamax (video cassette format introduced by Sony in 1975). The Betamax was a groundbreaking product, offering superior video and audio quality compared to its rival, VHS. Betamax was compact, reliable, and technologically advanced, poised to dominate the home video recording market. But consumers didn’t demonstrate the patience required to let the Betamax format’s value become realized. It ended as an almost forgotten footnote in the history of consumer electronics.

By contrast, MPMG investors have demonstrated significant patience and trust. Without these key ingredients, our methodology might go the way of Betamax. MPMG’s recent portfolio gains validate our approach, but we are most fulfilled by knowing we are making a positive difference in your lives.

We at MPMG sincerely thank you for your continued belief in our investment approach, trust, and patience.

© Jason Adam Katzenstein / The New Yorker Collection/The Cartoon Bank

A long way to grow

After such a strong nine months in the market, some investors are left wondering whether they have missed the best that the stock market has to offer. We do not think that this is the case. As the ancient Chinese proverb states, “The best time to plant a tree was 20 years ago. The second best time is now.” We believe that we currently sit at what could be a historical inflection point in the market. Consider where we have come from:

Since the 2008-2009 Global Financial Crisis (“GFC”), the economic landscape has dramatically tilted in favor of the Magnificent Seven technology giants—Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet, and Tesla—at the expense of diversification. This shift was propelled by two major waves of fiscal and monetary stimulus: first, multiple rounds of quantitative easing (“QE”) aimed at reflating asset prices in the GFC’s aftermath, and second, unprecedented interventions to rescue the economy during the COVID-19 pandemic. These policies fostered an era of artificially low interest rates, fueling a speculative investment boom that rewarded high-growth technology stocks that offered the potential of enormous (though questionable) earnings several years into the future.

Compounding this was the emergence of transformative technologies, including the rise of cloud computing and, more profoundly, artificial intelligence (“AI”), which ignited investor Fear of Missing Out (“FOMO”) and amplified valuations. As a result, the Magnificent Seven have ballooned to represent approximately 33% of the S&P 500’s market capitalization through the third quarter of 2025—an unprecedented level of concentration that underscores the index’s vulnerability to tech-sector volatility and raises questions about sustainable market breadth in a now normalizing rate environment.

Echoes of the past

As of the end of the third quarter of 2025, the top ten companies now account for more than 40% of the S&P 500 Index. This astounding level of imbalance is nearly twice the historical rate of the top ten’s concentration within the index, which as recently as 1991 was only 21%.

Why does this matter? Because high levels of concentration within the market historically have been harbingers of danger in that area of concentration. We saw other unusually high levels of market concentration (driven by the technology sector) prior to the technology-led implosion of 2000. More recently, we saw this same phenomenon take place right before the Great Financial Crisis when companies in the Financials sector, which typically accounts for 10 to 13% of the S&P 500, swelled to approximately 22% of the weighting of the S&P 500. These heightened levels of concentration are often of sign of excesses in the market, and market excesses typically correct.

This warning isn’t a call to run for the hills. Hardly. Because when pockets of the market are over-owned and over-loved, that means that there is significant opportunity in overlooked and underappreciated companies. This is how great wealth is created.

Another major factor that is making today’s market brittle and susceptible to big losses in these pockets of popularity is the shift that has occurred from active to passive investing in mutual funds and exchange traded funds.

Why does this matter? Because capital is automatically being poured into the largest companies, inflating valuations regardless of human judgment or fundamentals. As fundamental value investors, we believe that the price that we pay for a company is of paramount concern. When you buy a stock at 40-50 times earnings, you’re standing on a thin branch for one of the very last apples. One gust - slower growth, increased competition, technological obsolescence, etc. - and, well, gravity does the rest.

Source: Datastream, Compustat, Goldman Sachs Global Investment Research

Investors with FOMO should take note. As we proved in the early 2000s, there’s much more to the stock market than the overvalued, popular stocks. We’ve demonstrated this in 2025, generating significant returns among stocks found in the “under-discovered” 99% of the market. Not all stocks will prosper, but quality companies that are reasonably priced offer life-changing wealth accumulation potential. Planting a tree today offers excellent potential for long, healthy growth.

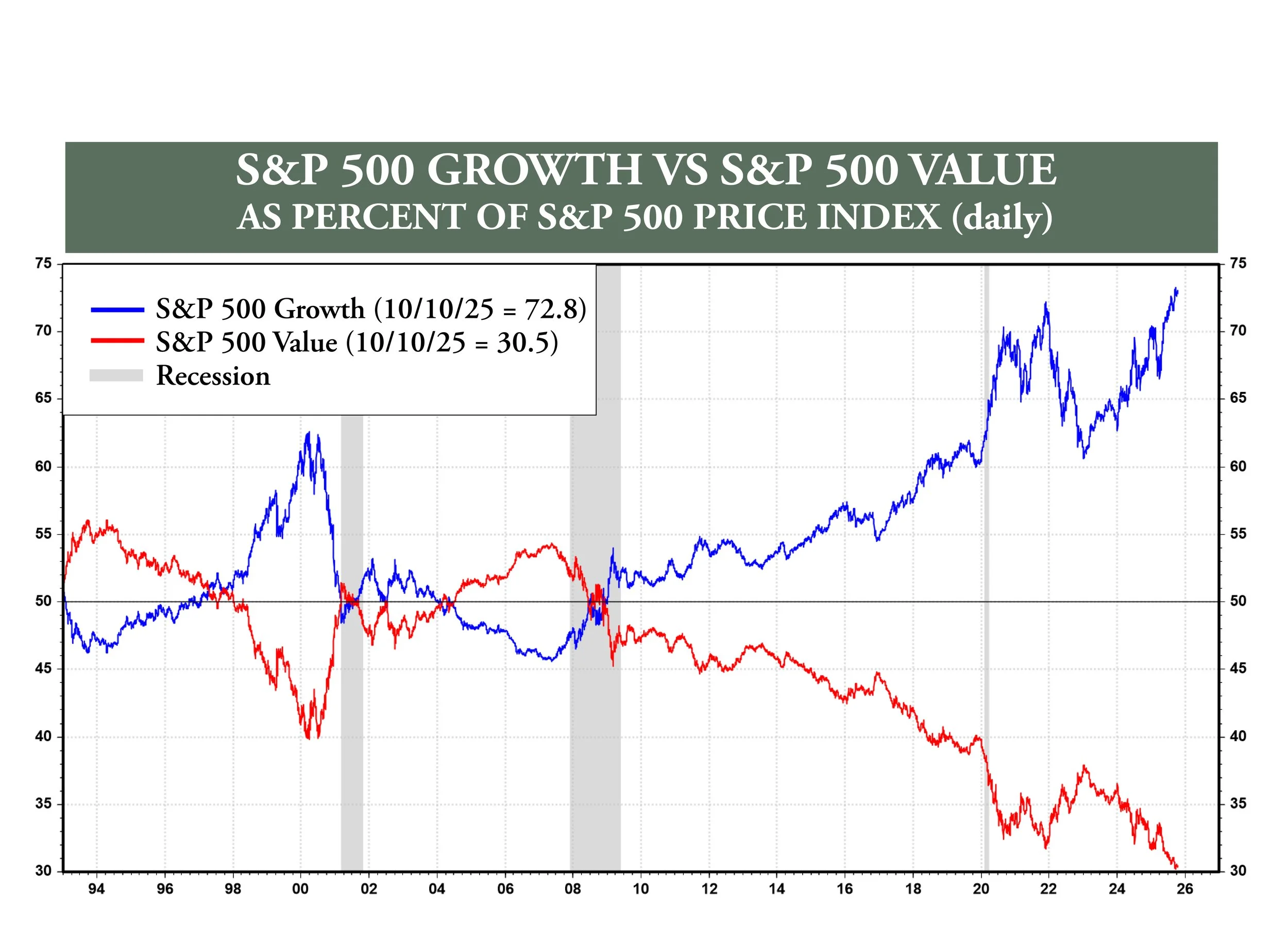

A rotation in waiting

Another reason investors should take heart is that, despite any short-term volatility, significant upside exists, largely due to the continued dominance of growth stocks over value stocks in the market. This, too, will pass, but for now, the growth-value relationship has reached record levels of imbalance. Well into 2025, growth stocks maintain an unprecedented performance advantage over value stocks, a trend dating back to 2009. Opportunity is plentiful on the other side of the market’s excesses.

Source: LSEG Datastream and © Yardeni Research. Standard & Poor’s.

It is worth noting that today’s pattern sharply contrasts with the long-term historical trend. Over the past 100 years, value stocks have outperformed growth stocks by more than 25 times2. Yet, since 2009, the performance gap favoring growth stocks over value stocks has reached record levels, becoming even more pronounced this year. Investors concerned about missing the upside can clearly see that on the value end of the market, significant opportunity remains.

The growth-value imbalance is a call to action. History shows that when growth stocks falter, they lose significantly more than value stocks, as value stocks’ low valuations should provide superior protection from significant declines. During the dot-com bust, many carefully curated value portfolios not only weathered the storm, but delivered meaningful positive returns. Meanwhile, tech-heavy portfolios suffered generational losses. Similarly, in 2008, diversified value strategies mitigated the pain of the financial sector’s collapse. Today, with growth stocks stretched to historic valuations, we believe that a rotation to value is overdue. This shift may not happen overnight, but the seeds are already planted. Normalizing economic conditions and increasing investor scrutiny of fundamentals will drive this change.

AI at the right price

The AI boom has driven the market’s 2025 resurgence. Businesses have significantly increased AI-related capital spending, providing fuel for the market’s continued growth. To date, growth stocks have been the biggest beneficiaries of investors’ enthusiasm for AI. This is particularly true for many members of the Magnificent Seven.

However, the benefits are gradually expanding to a broader range of stocks. Companies leveraging AI for practical applications are gaining traction. Oracle’s success reflects this trend, as its cloud platform supports AI workloads for a growing client base. Yet, unlike its peers, we believe that Oracle remains attractively priced, offering upside with reduced risk. Other holdings in our portfolio, from industrials to healthcare, share this profile: strong fundamentals, reasonable valuations, and exposure to transformative trends like AI, all overlooked by a market fixated on the Magnificent Seven.

Although AI has dominated market headlines for the better part of two years, the reality is that we may be only in the second inning of this transformational period. Investors should be rightly wary of overexuberance surrounding certain stocks. Selected AI-connected stocks are now priced at extreme valuation levels. Given the prices they carry, investors may see limited upside while taking on significant risk should the future diverge from their lofty expectations.

When markets are expensive, price really matters We believe that our portfolio is designed for this moment. We seek companies with strong management, defensible moats, and growth potential, often in sectors ignored by the broader market. These are not relics of a bygone era but dynamic businesses poised to thrive in a changing landscape.

The allure of FOMO-driven investing is powerful but perilous. Chasing overhyped stocks at peak valuations is akin to planting a tree in barren soil—it may sprout briefly but struggles to endure. MPMG’s philosophy is different. We avoid the crowd, focusing on price discipline and fundamental analysis. This discipline is especially critical in the AI era. While AI’s transformative potential is undeniable, not all beneficiaries are priced equally. Overpaying for widely loved growth stocks, trading at multiples that assume flawless execution, exposes investors to significant downside. In contrast, our holdings in AI-adjacent companies—those applying AI to drive efficiency or innovation—offer compelling risk-reward profiles. These firms, often underappreciated, are the saplings of tomorrow’s market leaders.

It’s Planting Season

The proverb “The best time to plant a tree was 20 years ago; the second-best time is now”, encapsulates our outlook. Today’s market, with its concentration risks and growth-value imbalance, is ripe for planting seeds in undervalued, high-quality companies. We believe that our portfolio is positioned to weather volatility and deliver lasting wealth. These are not tired companies but vibrant enterprises with the potential to grow tall, whether tied to AI, industrial innovation, or other emerging trends.

Investing, like planting a tree, requires patience and vision. The market’s inevitable storms—whether driven by economic shifts, regulatory changes, or technological disruptions—will test all investors. But those who plant wisely, in fertile soil with strong roots, will reap the rewards. By focusing on the “under-discovered” market, we are cultivating a forest of opportunities that will stand tall for years to come.

For investors with a value perspective, there is no need to wait for the “perfect” moment. A compelling story, a reasonable price, and a long-term horizon are all you need to plant today. We believe that this is the time to replace risky investments with better values that offer better protection from losses in the years to come. As our track record shows, patience is a virtue, and those who trust in our approach have been rewarded with a portfolio that thrives. Thank you for your continued trust in MPMG. We are committed to nurturing your investments for growth, resilience, and prosperity.

~MPMG

1 Please refer to disclosures on enclosed fact sheet, or refer to www.mpmgllc.com/fact-sheet, for appropriate disclaimers to performance.

2 From June 30, 1926 through December 31, 2023. Growth stocks = 500% Fama-French small growth and 500% Fama-French large growth returns rebalanced monthly.

Value stocks = 500% Fama-French small value and 500% Fama-French large value returns rebalanced monthly. The portfolios are formed on Book Equity/ Market

Equity at the end of each June using NYSE breakpoints via Eugene F. Fama and Kenneth R. French

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.