2025 | Q4- Great expectations

“Take nothing on its looks; take everything on evidence. There’s no better rule.”

~ Author Charles Dickens, Great Expectations

In Charles Dickens’ classic novel, Great Expectations, the orphan Pip inherits a fortune from a mysterious benefactor after a humble upbringing. With his newfound wealth, he becomes snobbish, distancing himself from his roots, only to discover that sudden affluence doesn’t guarantee fulfillment. When his lofty ambitions collide with harsh realities, Pip is left disillusioned. The book’s core lesson warns that unchecked expectations can blind us to true value, leading to profound disappointment. For value investors, this resonates deeply: just as Pip learns that genuine worth lies in authentic connections rather than superficial wealth, successful investing demands focusing on intrinsic value over hype, and avoiding the pitfalls of overinflated promises that often mask underlying risks.

This timeless caution from Dickens should strike a chord with investors navigating today’s markets. Wharton professor, prominent markets author, and two-time MPMG Speaker Series presenter Jeremy Siegel illustrates a parallel in his book The Future for Investors. He transports us back to 1950, the dawn of a golden economic era marked by the budding technological revolution. An investor with $1,000 to deploy would no doubt have been drawn to IBM, a company poised for generational growth in computing. A more discerning investor, however, might have turned their attention to the established oil giant Standard Oil of New Jersey (which later evolved into Exxon Mobil), seen as a steady, but unglamorous, choice.

© Barbara Smaller / The New Yorker Collection/The Cartoon Bank

IBM’s allure came at a steep price in 1950: its shares traded at an elevated average price-to-earnings (P/E) ratio of 26.8, with a modest dividend yield of just 2.18% - figures that screamed high expectations, but offered little margin for error. By contrast, Standard Oil embodied the value investor’s ideal, trading below 13 times earnings and boasting a generous 5.19% yield.

The long-term outcome was telling. By 2003, that $1,000 invested in Standard Oil had ballooned to $1.26 million, outpacing IBM’s return, which fell short of $1 million. While IBM’s innovative edge delivered solid growth, it couldn’t match the compounding power of Standard Oil’s undervalued stability - a classic example of the “growth trap” embedded in those 1950 valuations.

When growth falters - even modestly - overpriced stocks can plummet, much like Pip’s sudden windfall crumbling under the weight of reality. IBM’s 1950s hype, baked into its sky-high P/E, set the stage for underperformance when expectations weren’t met. The enduring lesson for investors, as Siegel underscores and MPMG’s value-based approach affirms, is to temper optimism, prioritize reasonable valuations, and favor patient compounders over euphoric bets. In a world of fleeting trends, true value rewards those who see beyond glamour.

Today’s growth trap?

For investors, the New Year usually starts with high hopes, and 2026 is no different. In fact, investor enthusiasm has been rampant since mid-April 2025 as investors shrugged off a tariff-concerned market decline of 19% in the S&P 500 Index to achieve a nearly 18% gain for the year.

As we’ve frequently highlighted in previous newsletters, investors today are placing their greatest expectations on the AI (artificial intelligence) trade. Since 2023, increased AI enthusiasm has benefited a select group of stocks considered essential to AI infrastructure. Like IBM in 1950, these are strong businesses, but with highly elevated valuations. Stocks of great businesses oftentimes underperform when the underlying value isn’t there. The continued influx of capital into these leading AI stocks suggests that many investors still perceive they are on the ground floor of the industry’s growth. However, as the example of investing in IBM during the 1950s illustrates, high expectations can skew perspective and lead to disappointment. This small group of stocks may already be in a “growth trap.” Investors must recognize the risks associated with such lofty expectations and should approach the markets more selectively.

A supportive economic foundation

Investor enthusiasm isn’t limited to the hot AI investment opportunities. The economy is showing numerous signs of strength, giving many investors little reason to demonstrate caution:

US economic growth significantly exceeded expectations in the third quarter of 2025, growing at a staggering 4.3% - the highest rate in two years. GDP growth was driven by strong global demand for American goods in sectors like technology, agriculture, and manufacturing amid favorable trade conditions. Meanwhile, 2026 projections, though varied, still indicate a stable and strong GDP growth rate.

The full-year effects of the recently passed One Big Beautiful Bill Act (signed into law on July 4, 2025) should serve as a tailwind for continued economic growth through easier financial conditions, tax cuts for families and businesses, and stimulus across nearly every economic sector.

Unemployment is holding below 5%, the threshold level that most economists consider to be “full employment.” Ongoing job additions are supportive of wage growth and household incomes.

The Federal Reserve remains in an interest rate-cutting cycle, which began in late 2024. Rate cuts have historically been a strong tailwind for stock prices.

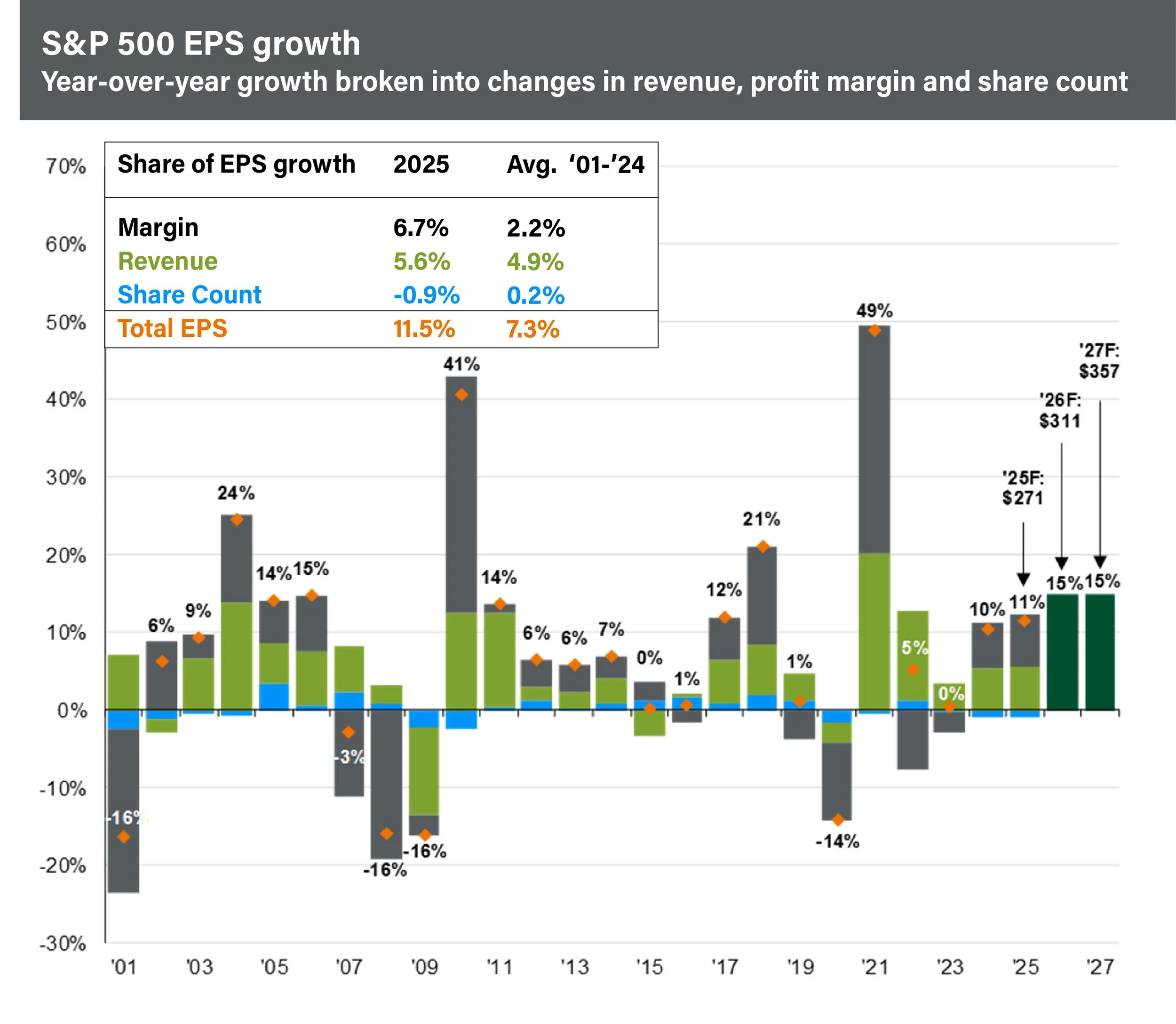

Perhaps most importantly, analysts expect the S&P 500 to grow earnings by 15% in 2026, which is nearly twice the trailing 10-year average (annual) earnings growth rate of 8.6%. This strength reflects broad-based sector participation, with all 11 S&P 500 sectors projected to report year-over-year earnings growth. AI adoption and productivity gains are key catalysts, particularly in technology-heavy sectors, boosting revenues and efficiencies.1

Source: J.P. Morgan Asset Management, Guide to the Markets (U.S.), Equities

This backdrop of robust growth, policy support, and accelerating corporate profits understandably fuels widespread market optimism. Yet, as disciplined value investors, we know from experience that periods of strong economic performance and market euphoria often breed complacency.

History reminds us - echoing the lessons of Great Expectations - that unchecked optimism can blind us to emerging risks, whether from shifting policy dynamics, inflationary pressures, or unforeseen geopolitical events.

While we embrace the positives today, vigilance remains essential: true long-term success in investing demands tempering enthusiasm with a steadfast focus on valuations, margins of safety, and the timeless principles of patience and prudence.

© Barbara Smaller / The New Yorker Collection/The Cartoon Bank

The broadening breadth of the market’s returns

As we close the books on 2025 from our vantage point in early 2026, the S&P 500’s impressive ~18% total return (compared to MPMG’s 26.9%*) underscores a pivotal shift: from narrow, mega-cap dominance to broader market participation. This broadening is a hallmark of a healthier market compared to narrow rallies, as it distributes gains across more stocks, mitigating concentration risks where a few names’ stumbles could derail progress.

The prior narrowness stemmed from the S&P 500’s market-cap weighting, where the largest stocks exerted outsized influence. Massive inflows into the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) drove their prices and market caps higher, ballooning their combined weighting of the S&P 500 index to approximately 34-35% by the end of 2025. This made the cap-weighted index (SPY) appear far stronger than the broader market in 2023-2024, masking limited participation from the “other 493” stocks.

In 2025, breadth expanded notably, reviving many forgotten companies beyond the Magnificent Seven. The Magnificent Seven posted an average 27.5% return, but with wide dispersion - only Alphabet (~65%) and Nvidia (~39%) beat the index, while laggards like Amazon (5.8%), Apple (8.8%), and Meta (13.6%) underperformed.

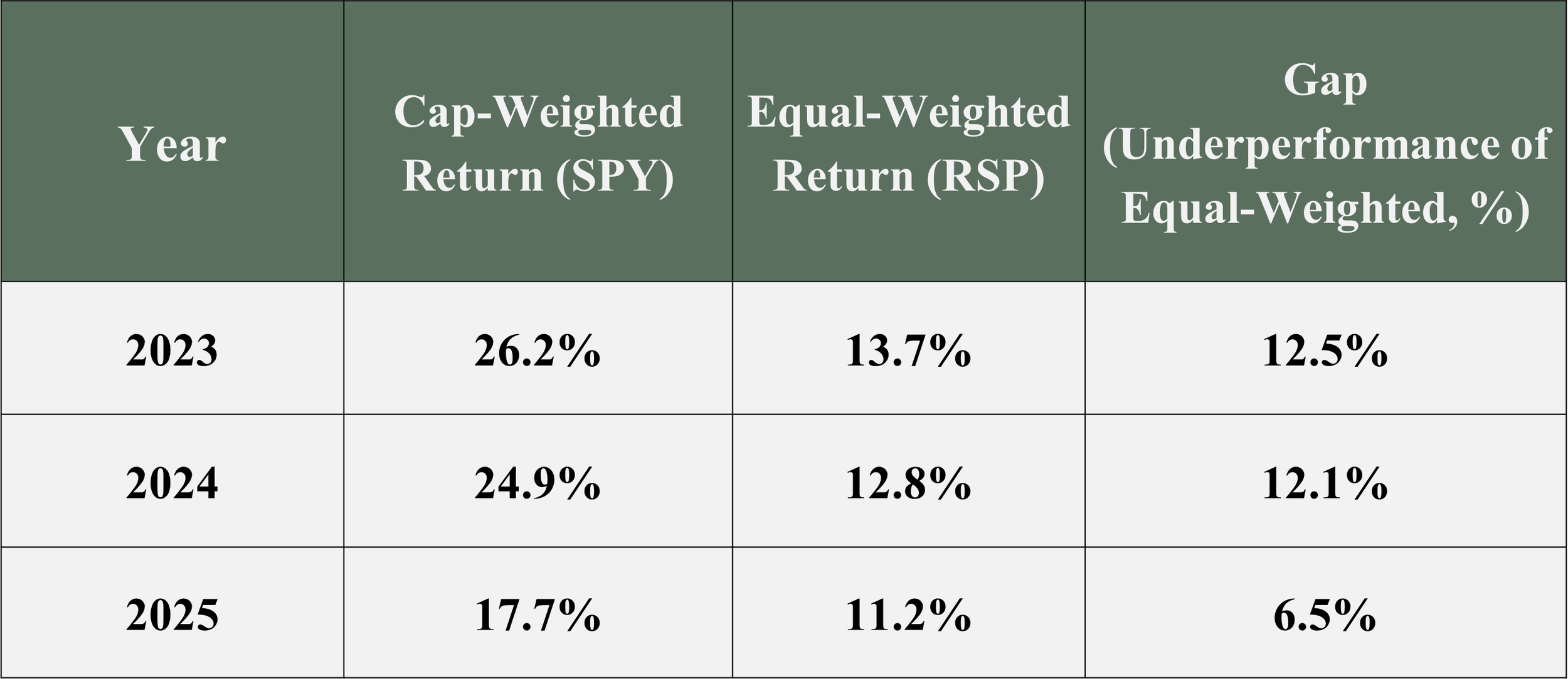

This divergence signaled that the once-unstoppable trade of chasing anything technology and mega-cap related - at any price - was losing steam, as investors grew wary of sky-high expectations embedded in those names. Instead, the door opened for the “other 493” stocks, with sectors like financials, industrials, utilities, and even niche areas like gold mining delivering outsized gains - some doubling or more. The equal-weighted S&P 500 index fund (RSP), which mitigates the market-cap weighted dominance of the Magnificent Seven, narrowed its underperformance gap significantly by year-end, as shown below:

This halving of the gap from prior years highlights how overlooked firms contributed meaningfully to the rally’s depth, spelling trouble for those blindly pursuing expensive momentum plays while creating exciting opportunities in undervalued areas.

Moreover, valuations paint an encouraging picture for these forgotten companies heading into 2026. While the Magnificent Seven are forecast to grow earnings by about 22%, they trade at a lofty ~31x forward earnings - a roughly 55% premium to the other 493’s more reasonable ~20x multiple. Meanwhile, the S&P 500 overall is projected for a solid 15% earnings expansion in 2026 - at a far more attractive cost.1

Stock pickers should be thrilled by this dynamic. As market breadth improves and attention finally shifts to overlooked pockets, we at MPMG see tremendous opportunity in reliable, undervalued compounders—steady businesses with strong dividends and modest valuations now poised to shine amid the rotation. Echoing Dickens’ lessons on tempered expectations, 2025 reminds us: in markets, true worth emerges beyond glamour, rewarding those who seek intrinsic value with patience and prudence.

2025 year in review

2025 was a year when investors faced major economic shifts, from new tariff policies to increased deregulation by the government, as well as the permanent extension of significant tax cuts. Investors had to adapt quickly to a changing macro environment. Throughout the year, we kept a realistic view of the evolving situation.

In the first quarter (“Feels Like the First Time”), markets were in the midst of their most volatile period in years. Stocks declined amid significant tariff uncertainty and fears of potentially negative economic consequences. Investors were nervous, forgetting that market downturns like the one seen in the first quarter are nothing new. We advised patience, reminding investors that some of the best opportunities arise during uncomfortable and uncertain times.

Our second quarter letter (“The Age of Acceleration”) emphasized that AI-driven technological progress is accelerating far beyond historical norms, rapidly eroding once-durable competitive advantages - making them shallower and narrower than ever. Examples abound, such as Oracle recently surpassing early leaders Microsoft, Amazon, and Alphabet in cloud infrastructure. Consequently, early AI trade winners are unlikely to dominate long-term, rendering the lofty premiums paid for hype-driven growth stocks increasingly questionable as their distant earnings potential becomes more remote amid faster obsolescence.

In the third quarter (“The Best Time to Plant a Tree…”), we congratulated our investors who remained patient with MPMG’s strategy and were now reaping the rewards. We also stated that despite strong returns through the first nine months, investors had not “missed out” on meaningful investment opportunities. This is because over the past several years massive amounts of capital chased expensive mega-cap technology stocks, leaving much of the market ignored and undervalued. This created tremendous opportunities for patient stock pickers to plant seeds in resilient, mispriced companies now, echoing the proverb: “the second-best time to plant a tree is now.”

Bring on the new year

As we step into 2026, the parallels to Charles Dickens’ Great Expectations feel more relevant than ever. For the better part of the last decade, the markets have rewarded those who chased the glittering promise of AI and mega-cap growth, much like Pip’s sudden inheritance dazzled him with possibilities. Yet, just as Pip eventually discovered that true fulfillment lay not in wealth alone but in genuine connections and grounded reality, 2025 revealed that lasting market returns are rarely sustained by a narrow circle of overhyped names.

The year delivered a powerful reminder: when euphoria drives valuations far beyond reasonable fundamentals, disappointment often follows. The Magnificent Seven’s wide performance dispersion, the narrowing gap between cap-weighted and equal-weighted indices, and the resurgence of forgotten sectors all point to a healthier, more balanced advance in the market - built on broader earnings growth, attractive valuations, and the quiet compounding of undervalued businesses.

This environment plays directly to our strengths. Our disciplined, value-based approach - rooted in evidence over appearance, patience over speculation, and intrinsic worth over fleeting trends - positions us to capitalize on the opportunities now emerging in overlooked pockets of the market. While many investors remain transfixed by yesterday’s winners trading at premium multiples, we are excited by the steady compounders offering meaningful dividends, strong balance sheets, and reasonable prices that reflect reality rather than fantasy.

History, experience, and Dickens all teach the same lesson: unchecked expectations can blind us, but tempered optimism grounded in rigorous analysis endures. We remain enthusiastic about the economic backdrop and the long-term potential of equities, yet ever vigilant - focusing on quality, misunderstood, and inexpensive businesses while avoiding the growth traps that have ensnared so many before.

We wish everybody a healthy & prosperous 2026!

~MPMG

1 FactSet; 12/16/2025

* Please see enclosed Notes to Performance. Notes to Performance can also be found at https://mpmgllc.com/fact-sheet.

Established in 1995, Minneapolis Portfolio Management Group, LLC actively manages separate accounts for individuals, families, trusts, retirement funds, and institutions. Our proven value-oriented investment philosophy has created long-term wealth for our clients.

Visit our website at: www.MPMGLLC.com

Although the information in this document has been carefully prepared and is believed to be accurate as of the date of publication, it has not been independently verified as to its accuracy or completeness. Information and data included in this document are subject to change based on market and other condition. All prices mentioned above are as of the close of business on the last day of the quarter unless otherwise noted. Market returns discussed in this letter are total returns (including reinvestment of dividends) unless otherwise noted.

The information in this document should not be considered a recommendation to purchase any particular security. There is no assurance that any of the securities noted will be in, or remain in, an account portfolio at the time you receive this document. It should not be assumed that any of the holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable. The past performance of investments made by MPMG does not guarantee the success of MPMG’s future investments. As with any investment, there can be no assurance that MPMG’s investment objective will be achieved or that an investor will not lose a portion or all of its investment.

Companies mentioned in this document were chosen based on MPMG’s view of the products and/or services offered or provided by the companies in light of current economic and market observations and reported trends. For a complete listing of MPMG’s recommendations over the preceding 12 months, please contact MPMG at (612) 334-2000.